We have given these Accountancy Class 12 Important Questions and Answers Chapter 4 Reconstitution of Partnership Firm: Retirement/Death of a Partner to solve different types of questions in the exam. Go through these Class 12 Accountancy Chapter 4 Reconstitution of Partnership Firm: Retirement/Death of a Partner Class 12 Important Questions and Answers Solutions & Previous Year Questions to score good marks in the board examination.

Reconstitution of Partnership Firm: Retirement/Death of a Partner Important Questions Class 12 Accountancy Chapter 4

Question 1.

What is meant by‘gaining ratio on retirement of a partner (Delhi 2019)

Answer:

The ratio in which the continuing partners acquire the outgoing partner’s share is called as gaining ratio.

Question 2.

Aman, Yatin and Uma were partners and were sharing profits and losses in the ratio of 5 : 3 : 2. Uma retired and her share was taken over by Aman and Yatin 5 : 3 in ratio. Calculate gaining ratio of Aman and Yatin. (Compartment 2018)

Answer:

Calculation of Gaining Ratio

Uma’s share = \(\frac{2}{10}\)

Aman gams = \(\frac{5}{8} \times \frac{2}{10}=\frac{10}{80}\)

Yatin gams = \(\frac{3}{8} \times \frac{2}{10}=\frac{6}{80}\)

Gaining ratio of Aman and Yatin = 10 : 6 = 5 : 3

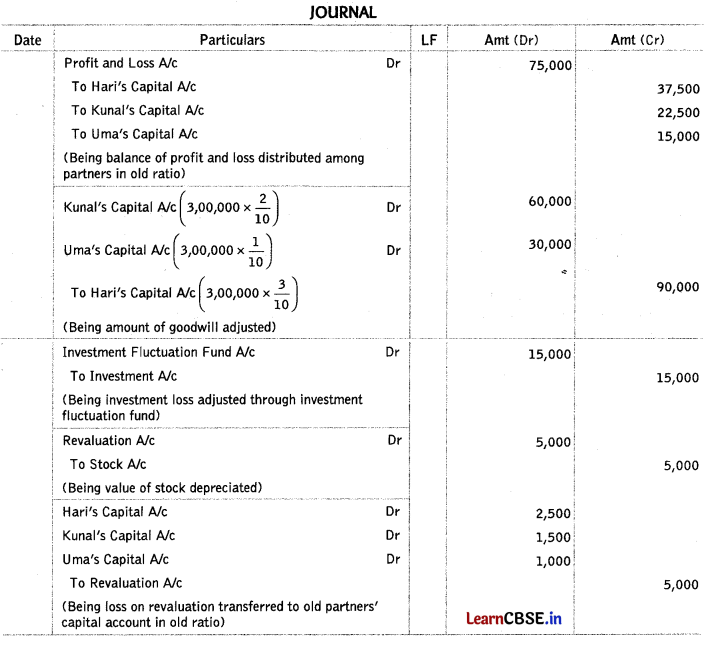

![Reconstitution of Partnership Firm: Retirement/Death of a Partner Class 12 Important Questions and Answers Accountancy Chapter 4]()

Question 3.

X, Y and Z are partners sharing profits in the ratio of \(\frac{1}{2}\), \(\frac{2}{5}\) and \(\frac{1}{10}\). Find the new ratio of remaining partners, if Z retires. (Delhi 2014)

Answer:

Old ratio of X : Y : Z = \(\frac{1}{2} : \frac{2}{5} : \frac{1}{10}=\frac{5}{10} : \frac{4}{10} : \frac{1}{10}\)

= 5 : 4 : 1

Z retires, after striking of the retiring Parmer’s ratio, remaining ratio will be new profit sharing ratio, i.e. 5 : 4.

Question 4.

X, Y and Z were partners sharing profits in the ratio of \(\frac{1}{2}\), \(\frac{3}{10}\) and \(\frac{1}{5}\) X retired from the firm. Calculate the gaining ratio of the remaining partners. (All India 2014)

Answer:

Old ratio of X : Y : Z = \(\frac{1}{2}: \frac{3}{10}: \frac{1}{5}=\frac{5}{10}: \frac{3}{10}: \frac{2}{10}\)

= 5 : 3 : 2

X retired, after striking of the retiring partner’s ratio, remaining ratio will be new profit sharing ratio, i.e. 3 : 2,

New profit sharing ratio = Y : Z = 3 : 2

Gaining Ratio = New Share – Old Share

Y = \(\frac{3}{5}-\frac{3}{10}=\frac{6-3}{10}=\frac{3}{10}\)

Z = \(\frac{2}{5}-\frac{2}{10}=\frac{4-2}{10}=\frac{2}{10}\)

Gainingratio = 3 : 2

Question 5.

Give any one distinction between sacrificing ratio and gaining ratio. (All India 2012)

Answer:

The difference between sacrificing ratio and gaining ratio is stated below

Sacrificing ratio:

It is the ratio in which old partners agree to sacrifice their share of profit in favour of new partner(s).

Gaining ratio:

It is the ratio in which continuing partners acquire the share of profit from outgoing partner(s).

Question 6.

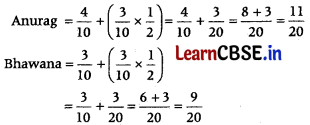

(i) K, L and Z are partners sharing profits in the ratio of 4 : 3 : 2 respectively. L retired and surrendered \(\frac{1}{9}\)th of his share of profit to K and remaining in favour of Z. Calculate the new profit sharing ratio of K and Z.

(ii) Arun, Varun and Charan are partners sharing profits in the ratio of \(\frac{1}{2}\), \(\frac{3}{10}\) and \(\frac{1}{5}\) respectively. Varun retired from the firm and Arun and Charan decided to share future profits in 3 : 2 ratio. Calculate gaining ratio of Arun and Charan. (All Indio (C) 2014)

Answer:

(i) Old ratio between K, L and Z = 4 : 3 : 2.

Share surrendered in favour of K by L

= \(\frac{3}{9} \times \frac{1}{9}=\frac{3}{81}\)

Share surrendered in favour of Z by L

![Reconstitution of Partnership Firm Retirement Death of a Partner Class 12 Important Questions and Answers Accountancy Chapter 4 Img 1]()

∴ New ratio = 39 : 42 or 13 : 14

(ii) Old ratio between Arun, Varun and Charan

= \(\frac{1}{2}: \frac{3}{10}: \frac{1}{5}\) = 5 : 3 : 2

New ratio between Arun and Charan = 3 : 2

Gaining Ratio = New Share – Old Share

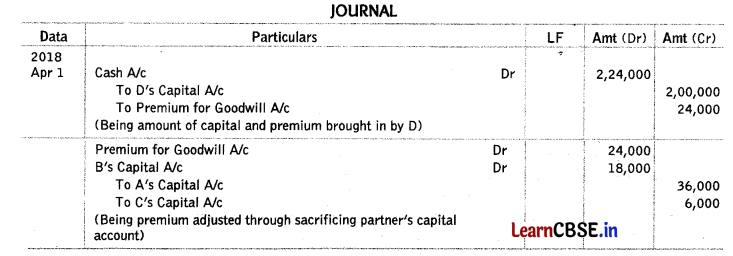

![Reconstitution of Partnership Firm Retirement Death of a Partner Class 12 Important Questions and Answers Accountancy Chapter 4 Img 2]()

Question 7.

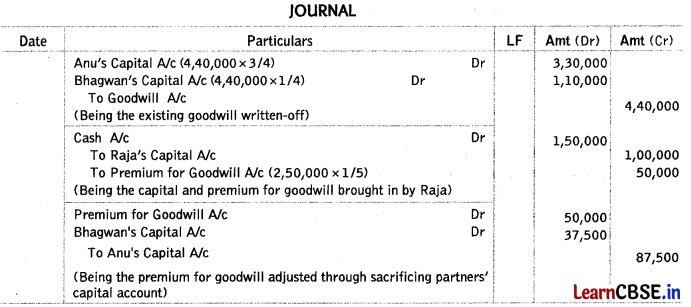

Aman, Bimal and Deepak are partners sharing profits in the ratio of 2 : 3 : 5 . The goodwill of the firm has been valued at ₹ 37,500. Aman retired, Bimal and Deepak decided to share profits equally in future. Calculate gain/sacrifice of Bimal and Deepak on Aman’s retirement and also pass necessary journal entry for the treatment of goodwill. (All India 2019)

Answer:

Calculation of Sacrificing or Gaining Ratio

Sacrificing Ratio = Old share – New share

Bimal = \(\frac{3}{10}-\frac{1}{2}=\frac{3-5}{10}=\left(\frac{2}{10}\right)\); Deepak = \(\frac{5}{10}-\frac{1}{2}=\frac{5-5}{10}\) = Nil

Aman’s Share of Goodwill = 37,500 × \(\frac{2}{10}\) = ₹ 7,500

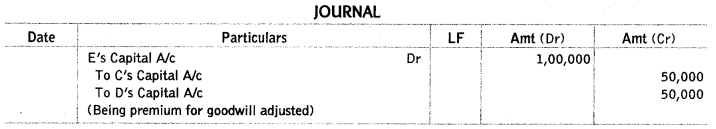

![Reconstitution of Partnership Firm Retirement Death of a Partner Class 12 Important Questions and Answers Accountancy Chapter 4 Img 3]()

Question 8.

Neetu, Meetu and Teetu were partners in a firm. On 1st January, 2018, Meetu retired. On Meetu’s retirement, the goodwill of the firm was valued at X 4,20,000. Pass necessary journal entry for the treatment of goodwill on Meetu’s retirement. (CBSE 2018)

Answer:

![Reconstitution of Partnership Firm Retirement Death of a Partner Class 12 Important Questions and Answers Accountancy Chapter 4 Img 4]()

Working Note:

meetu’s share of goodwill = 4,20,000 × \(\frac{1}{3}\) = 1,40,000

Question 9.

Why are heirs of a retiring/deceased partner entitled to the share of goodwill of the firm? (Delhi 2014)

Answer:

The retiring or deceased partner is entitled to his share of goodwill at the time of retirement/death because the goodwill has been earned by the firm at the time when he was a partner.

Question 10.

P, Q and R were partners in a firm sharing profits in the ratio of 5 : 4 : 3 respectively. Their capitals were ₹ 50,000, ₹ 40,000 and ₹ 30,000 respectively. State the ratio in which the goodwill of the firm, amounting to ₹ 6,00,000, will be adjusted in the capital accounts of the remaining partners on the retirement of Q. (Delhi (C) 2014)

Answer:

The goodwill will be adjusted in the gaining ratio of the continuing partners.

Question 11.

For which share of goodwill, a partner is entitled at the time of his retirement? (Delhi 2012)

Answer:

At the time of retirement, a partner is entitled to get an amount equal to his share out of firm’s goodwill.

Question 12.

P, Q and R were partners in a firm sharing profits in the ratio of 5 : 4 : 3. Their capitals were ₹ 40,000, ₹ 50,000 and ₹ 1,00,000 respectively. State the ratio in which the goodwill of the firm amounting to ₹ 1,20,000 will be adjusted on the retirement of R. (All India (C) 2010)

Answer:

R’s share of goodwill, i.e. ₹ 30,000 (1,20,000 × 3/12) will be contributed by P and Q in their gaining ratio, i.e. 5 : 4.

Question 13.

State the need for treatment of goodwill on the retirement of a partner. (All India 2010)

Answer:

At the time of retirement, retiring partner sacrifices his share of profit in favour of continuing partners, so the remaining partners compensate the retiring partner a share of the firm’s goodwill.

Question 14.

Kavi, Ravi, Kumar and Guru were partners in a firm sharing profits in the ratio of 3 : 2 : 2 : 1. On 1st February, 2017, Guru retired and the new profit sharing ratio decided between Kavi, Ravi and Kumar was 3 : 1 : 1. On Guru’s retirement, the goodwill of the firm was valued at ₹ 3,60,000. Showing your working notes clearly, pass necessary journal entry in the books of the firm for the treatment of goodwill on Guru’s retirement. (All india 2017)

Answer:

![Reconstitution of Partnership Firm Retirement Death of a Partner Class 12 Important Questions and Answers Accountancy Chapter 4 Img 5]()

Working Notes:

1. Calculation of Gaining Ratio

Gaining Ratio = New Share – Old Share

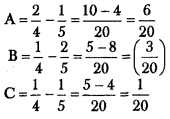

![Reconstitution of Partnership Firm Retirement Death of a Partner Class 12 Important Questions and Answers Accountancy Chapter 4 Img 6]()

2. Calculation of Share of Goodwill

Guru’s share of goodwill = 3,60,000 × \(\frac{1}{8}\) = ₹ 45,000

Kavi gains = 3,60,000 × \(\frac{9}{40}\) = ₹ 81,000

Ravi sacrifices = 3,60,000 × \(\frac{2}{40}\) = ₹ 18,000

Kumar sacrifices = 3,60,000 × \(\frac{2}{40}\) = ₹ 18,000

Question 15.

Amar, Ram, Mohan and Sohan were partners in a firm sharing profits in the ratio of 2 : 2 : 2 : 1, on 31st January, 2017 Sohan retired. On Sohan’s retirement the goodwill of the firm was valued at ₹ 70,000. The new profit sharing ratio between Amar, Ram and Mohan was agreed as 5 : 1 : 1. Showing your working notes clearly, pass necessary journal entry for the treatment of goodwill in the books of the firm on Sohan’s retirement. (Delhi 2017)

Answer:

Solve as Q no. 8 on page 161 and 162.

Debit Amur’s Capital Account with ₹ 30,000 and Credit Ram’s, Mohan’s and Sohan’s Capital account with ₹ 10,000 each.

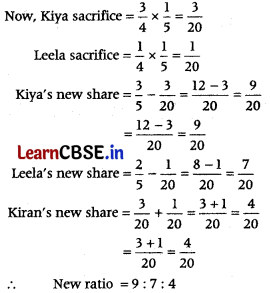

Question 16.

Arjun, Bheem and Nakul are partners sharing profits and losses in the ratio of 14 : 5 : 6 respectively. Bheem retires and surrenders his 5/25th share in favour of Arjun. The goodwill of the firm is valued at 2 years purchase of super profits based on average profits of last 3 years. The profits of the last three years are ₹ 50,000, ₹ 55,000 and ₹ 60,000 respectively. The normal profits of the similar firms are ₹ 30,000. Goodwill already appears in the books of the firm at ₹ 75,000. The profit for the first year after the Bheem’s retirement was ₹ 1,00,000. Give necessary journal entries to adjust goodwill and distribute profits showing your workings. (Delhi 2012)

Answer:

![Reconstitution of Partnership Firm Retirement Death of a Partner Class 12 Important Questions and Answers Accountancy Chapter 4 Img 7]()

Working Notes:

1. Calculation of New Profit Sharing Ratio and Gaining Ratio

Old ratio of Aijun, Bheem and Nakul = 14 : 5 : 6

Bheem surrenders in favour of Arjun = \(\frac{5}{25}\)th share, Arjun’s new share = \(\frac{14}{25}+\frac{5}{25}=\frac{19}{25}\)

New ratio of Aijun and Nakul = 19 : 6

Gaining Ratio = New Share – Old Share

Arjun = \(\frac{19}{25}-\frac{14}{25}=\frac{19-14}{25}=\frac{5}{25}\); Nakul = \(\frac{6}{25}-\frac{6}{25}=\frac{6-6}{25}\) = Nil

2. Calculation of Bheem’s Share of Goodwill

Actual average profit = \(\frac{50,000+55,000+60,000}{3}\) = ₹ 55,000; Normal profit = ₹ 30,000

Super Profit = Average Profit – Normal Profit = 55,000 – 30,000 = ₹ 25,000

Firm’s goodwill = 25,000 × 2 = ₹ 50,000

Bheem’s share of goodwill = 50,000 × \(\frac{5}{25}\) = ₹ 10,000 (to be contributed by Arjun alone)

![Reconstitution of Partnership Firm: Retirement/Death of a Partner Class 12 Important Questions and Answers Accountancy Chapter 4]()

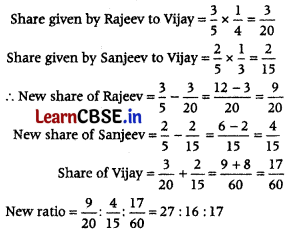

Question 17.

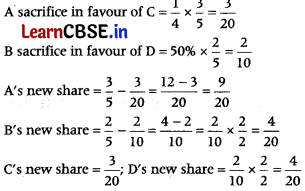

A, B, C and D are partners sharing profits in the ratio of 3 : 3 : 2 : 2 respectively. D retires and A, B and C decide to share the future profits in the ratio of 3 : 2 : 1. Goodwill of the firm is valued at ₹ 6,00,000. Goodwill already appears in the books at ₹ 4,50,000. The profit for the 1st year after D’s retirement amount to ₹ 12,00,000. Give the necessary journal entries to record goodwill and to distribute the profits. Show your calculations clearly. (All India 2012)

Answer:

Solve as Q no. 10 on page 162 and 163.

A gains \(\frac{6}{30}\)th share, B gains \(\frac{1}{30}\)th share and C sacrifices \(\frac{1}{30}\)th share.

Question 18.

A, B and C were partners in a firm sharing profits in the ratio of 6 : 5 : 4. Their capitals were A ₹ 1,00,000, B ₹ 80,000 and C ₹ 60,000 respectively. On 1st April, 2009, C retired from the firm and the new profit sharing ratio between A and B was decided as 11 : 4. On C’s retirement, the goodwill of the firm was valued at ₹ 90,000. Showing your calculations clearly, pass necessary journal entry for the treatment of goodwill on C’s retirement. (All India 2010)

Answer:

Solve as Q no. 8 on page 161.

Debit A’s capital account with ₹ 30,000, Credit B’s capital account and C’s capital account with ₹ 6,000 and ₹ 24,000 respectively.

Question 19.

A, B and C were partners sharing profits in the ratio of 6 : 4 : 5. Their capitals were A ₹ 1,00,000, B ₹ 80,000 and C ₹ 60,000. On 1st April, 2009, B retired from the firm and the new profit sharing ratio between A and C was decided as 11 : 4. On B’s retirement, the goodwill of the firm was valued at ₹ 1,80,000. Showing your calculations clearly, pass necessary journal entry for the treatment of goodwill on B’s retirement. (Delhi 2010)

Answer:

Solve as Q. no. 8 on page 161.

Debit A’s capital account with ₹ 60,000, Credit B’s capital account and C’s capital account with ₹ 48,000 and ₹ 12,000 respectively.

Question 20.

P, Q and R were partners in a firm. On 31st March, 2018 R retired. The amount payable to R ₹ 2,17,000 was transferred to his loan account. R agreed to receive interest on this amount as per the provisions of Partnership Act, 1932. State the rate at which interest will be paid to R. (Delhi 2019)

Answer:

As per the provisions of Partnership Act, 1932, the rate of interest payable to R will be 6% per annum.

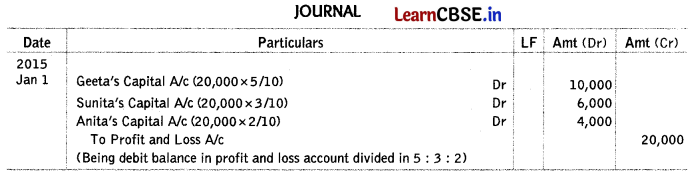

Question 21.

Give the journal entry to distribute ‘workmen compensation reserve of ₹ 60,000 at the time of retirement of Sajjan, when there is no claim against it. The firm has three partners Rajat, Sajjan and Kavita. (Delhi 2013)

Answer:

![Reconstitution of Partnership Firm Retirement Death of a Partner Class 12 Important Questions and Answers Accountancy Chapter 4 Img 8]()

NOTE Since, the profit sharing ratio is not given, it is distributed equally.

Question 22.

Give the journal entry to distribute workmen compensation reserve of ₹ 70,000 at the time of retirement of Neeti, when there is a claim of ₹ 25,000 against it. The firm has three partners Raveena, Neeti and Rajat. (All India 2013)

Answer:

![Reconstitution of Partnership Firm Retirement Death of a Partner Class 12 Important Questions and Answers Accountancy Chapter 4 Img 9]()

NOTE Since, the profit sharing ratio is not given, it is distributed equally.

Question 23.

Ram, Mohan and Sohan were partners in a firm sharing profits in the ratio of 4 : 3 : 2. Mohan retired and his share was taken over equally by Ram and Sohan. In which ratio will the profit or loss on revaluation of assets and liabilities on the retirement of Mohan be transferred to the capital accounts of the partners? (Delhi (C) 2010)

Answer:

The profit or loss on revaluation of assets and liabilities on the retirement of Mohan will be transferred to the capital accounts of the partners in their old ratio, i.e. 4 : 3 : 2.

Question 24.

Banwari, Girdhari and Murari are partners in a firm sharing profits and losses in the ratio of 4 : 5 : 6. On 31st March, 2014, Girdhari retired. On that date the capitals of Banwari, Girdhari and Murari before the necessary adjustments stood at ₹ 2,00,000, ₹ 1,00,000 and ₹ 50,000, respectively. On Girdhari’s retirement, goodwill of the firm was valued at ₹ 1,14,000. Revaluation of assets and re-assessment of liabilities resulted in a profit of ₹ 6,000. General reserve stood in the books of the firm at ₹ 30,000.

The amount payable to Girdhari was transferred to his loan account. Banwari and Murari agreed to pay Girdhari two yearly instalments of ₹ 75,000 each including interest @ 10% per annum on the outstanding balance during the first two years and the balance including interest in the third year. The firm closes its books on 31st March every year.

Prepare Girdhari’s loan account till it is finally paid showing the working notes clearly. (CBSE 2018)

Answer:

![Reconstitution of Partnership Firm Retirement Death of a Partner Class 12 Important Questions and Answers Accountancy Chapter 4 Img 10]()

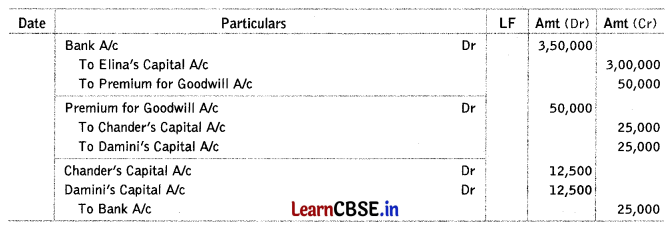

Question 25.

Alok, Narendra and Shiv were partners in a firm sharing profits in the ratio of 5 : 3 : 2. Goodwill appeared at ₹ 90,000 and general reserve at ₹ 50,000 in the books of the firm. Narendra decided to retire from the firm. On the date of his retirement, goodwill of the firm was valued at f 2,40,000. The new profit sharing ratio of Alok and Shiv was 2 : 3. Record necessary journal entries on Narendra’s retirement. (All India (C) 2015)

Answer:

![Reconstitution of Partnership Firm Retirement Death of a Partner Class 12 Important Questions and Answers Accountancy Chapter 4 Img 11]()

Working Note:

Calculation of Gaining Ratio

Gaining Ratio = New Share – Old Share

Alok = \(\frac{2}{5}-\frac{5}{10}=\frac{4-5}{10}=\left(\frac{1}{10}\right)\) sacrifise; Shiv = \(\frac{3}{5}-\frac{2}{10}=\frac{6-2}{10}=\frac{4}{10}\) gain

![Reconstitution of Partnership Firm: Retirement/Death of a Partner Class 12 Important Questions and Answers Accountancy Chapter 4]()

Question 26.

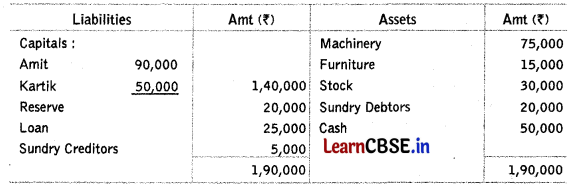

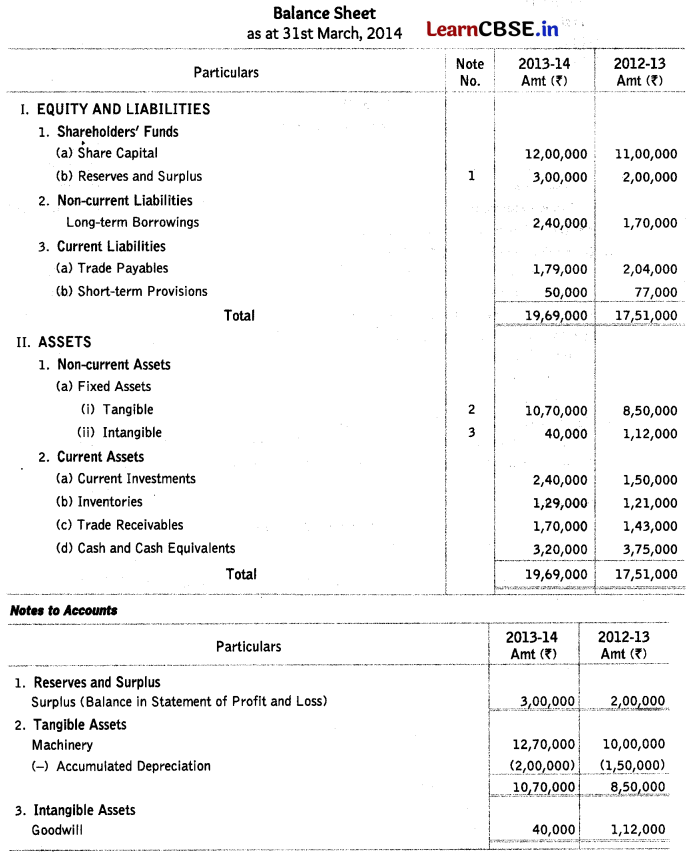

Raman, Ratan and Rajan were partners sharing profits in the ratio of 4 : 2 : 1 respectively. Following was their balance sheet as at 31st March, 2013.

![Reconstitution of Partnership Firm Retirement Death of a Partner Class 12 Important Questions and Answers Accountancy Chapter 4 Img 12]()

On the above date, Raman retired and following were agreed

(i) The assets and liabilities were valued as: stock ₹ 24,000; debtors ₹ 21,000; building ₹ 45,200; plant ₹ 50,000 and creditors ₹ 28,000.

(ii) Amount due to Raman will be transferred to Raman’s loan account.

Prepare revaluation account and Raman’s capital account. (Delhi to 2014)

Answer:

![Reconstitution of Partnership Firm Retirement Death of a Partner Class 12 Important Questions and Answers Accountancy Chapter 4 Img 13]()

Question 27.

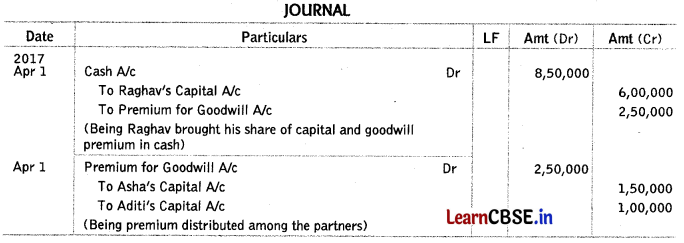

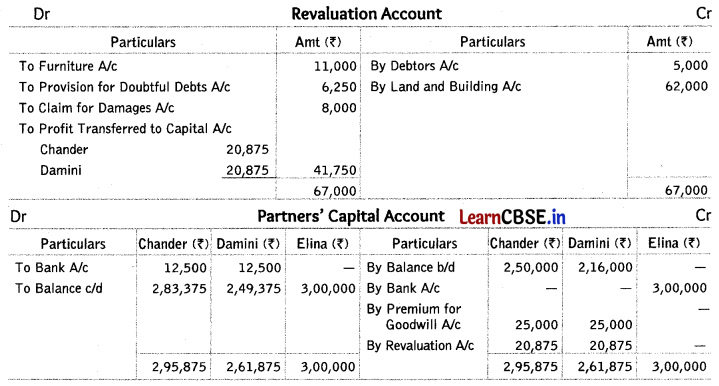

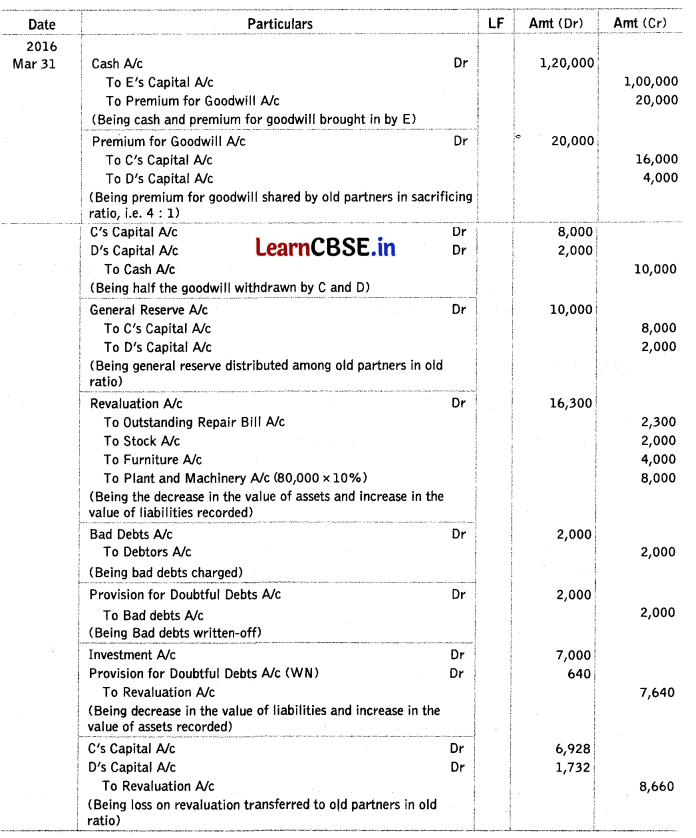

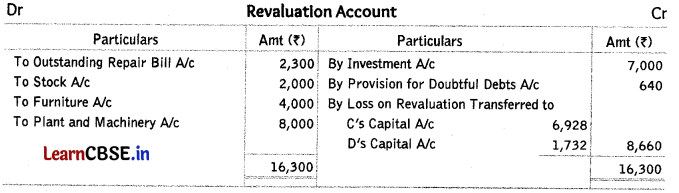

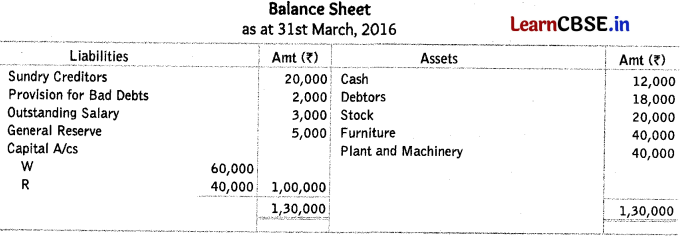

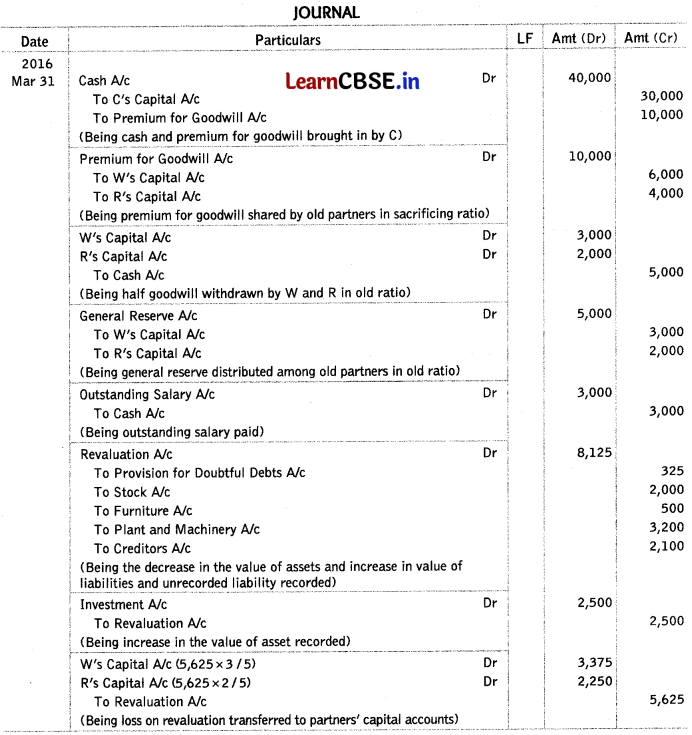

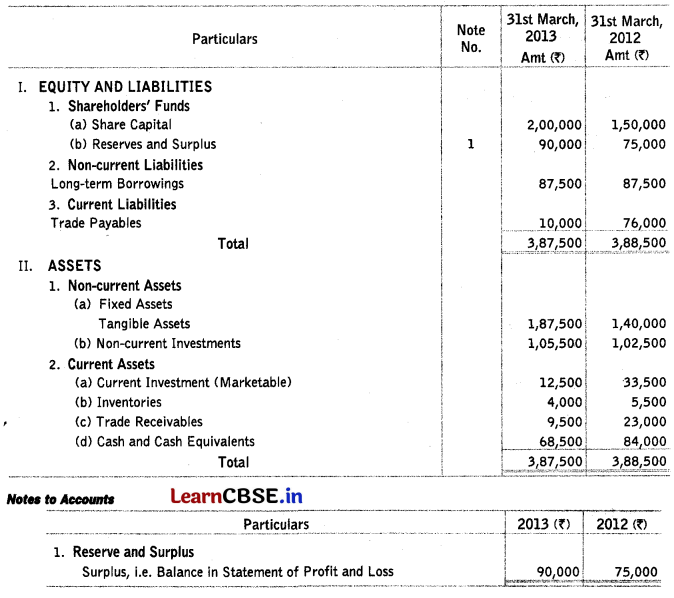

Sameer, Yasmin and Saloni were partners in a firm sharing profits and losses in the ratio of 4 : 3 : 3. On 31st March, 2016, their balance sheet was as follows (All india 2017)

![Reconstitution of Partnership Firm Retirement Death of a Partner Class 12 Important Questions and Answers Accountancy Chapter 4 Img 14]()

On the above date, Sameer retired and it was agreed that

(i) Debtors of ₹ 4,000 will be written-off as bad debts and a provision of 5% on debtors for bad and doubtful debts will be maintained.

(ii) An unrecorded creditor of ₹ 20,000 will be recorded.

(iii) Patents will be completely written-off and 5% depreciation will be charged on stock, machinery and building.

(iv) Yasmin and Saloni will share the future profits in the ratio of 3 : 2.

(v) Goodwill of the firm on Sameer’s retirement was valued at ₹ 5,40,000.

Pass necessary journal entries for the above transactions in the books of the firm on Sameer’s retirement.

![Reconstitution of Partnership Firm Retirement Death of a Partner Class 12 Important Questions and Answers Accountancy Chapter 4 Img 15]()

Working Notes:

1. Calculation of Gaining Ratio

Gaining Ratio = New Share – Old Share

Yasmin = \(\frac{3}{5}-\frac{3}{10}=\frac{6-3}{10}=\frac{3}{10}\); saloni = \(\frac{2}{5}-\frac{3}{10}=\frac{4-3}{10}=\frac{1}{10}\)

Gaining ratio = 3 : 1

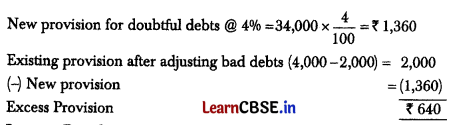

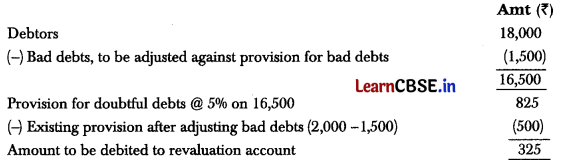

2. Provision for Bad Debts:

![Reconstitution of Partnership Firm Retirement Death of a Partner Class 12 Important Questions and Answers Accountancy Chapter 4 Img 16]()

3. Calculation of Sameer’s Share of Goodwill

Firm’s goodwill = ₹ 5,40,000

Sameer’s share = 5,40,000 × \(\frac{4}{10}\) = ₹ 2,16,000

To be contributed by Yasmin and Saloni in their gaining ratio, i.e. 3 : 1.

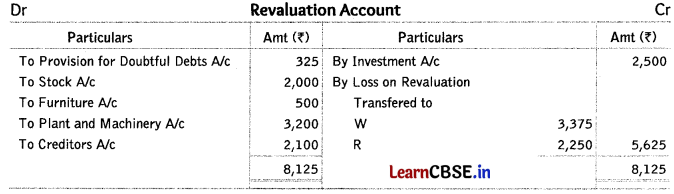

4. Loss on Revaluation

It can be ascertained by preparing revaluation account in the following manner

![Reconstitution of Partnership Firm Retirement Death of a Partner Class 12 Important Questions and Answers Accountancy Chapter 4 Img 17]()

Question 28.

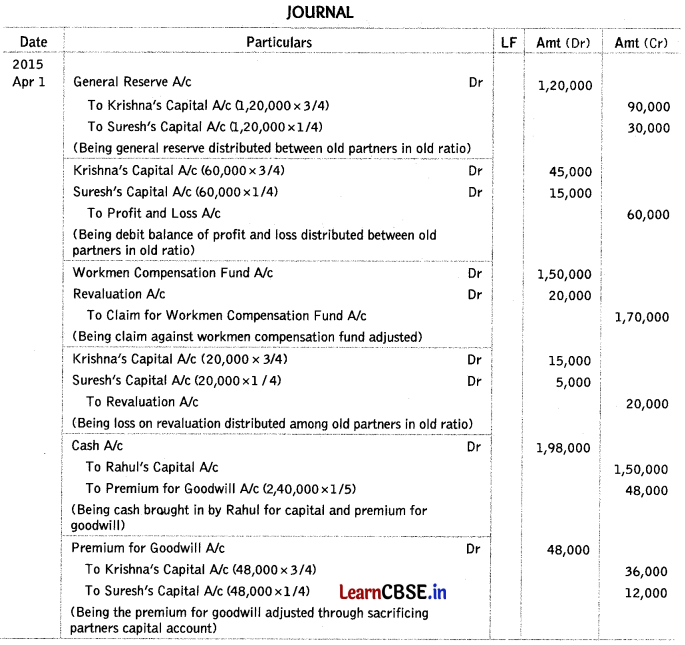

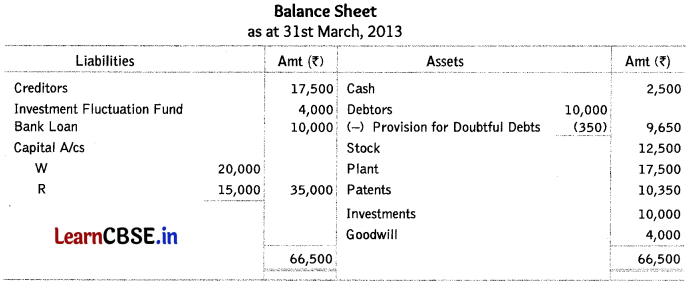

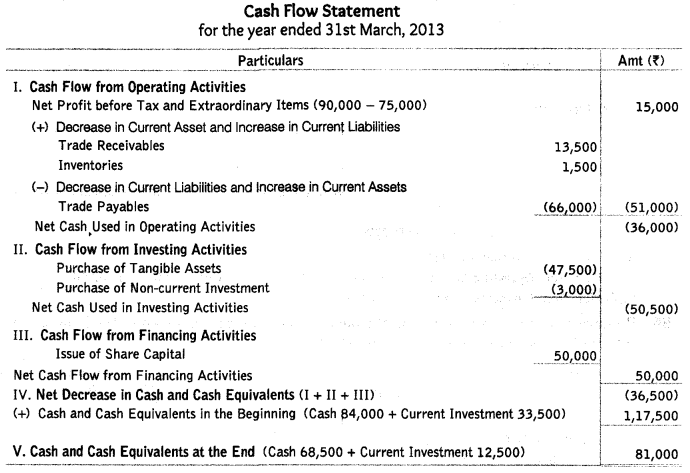

M, N and G were partners in a firm sharing profits and losses in the ratio of 5 : 3 : 2. On 31st March, 2016 their balance sheet was as under (Delhi 2017)

![Reconstitution of Partnership Firm Retirement Death of a Partner Class 12 Important Questions and Answers Accountancy Chapter 4 Img 18]()

M retired on the above data and it was agreed that

(i) Debtors of ₹ 2,000 will be written-off as bad debts and a provision of 5% on debtors for bad and doubtful debts will be maintained.

(ii) Patents will be completely written-off and stock, machinery and building will be depreciated by 5%.

(iii) An unrecorded creditor of ₹ 10,000 will be taken into account.

(iv) N and G will share the future profits in the ratio of 2 : 3.

(v) Goodwill of the firm on M’s retirement was valued at ₹ 3,00,000.

Pass necessary journal entries for the above transactions in the books of the firm on M’s retirement.

Answer:

Solve as Q no. 8 on page 170-172.

Loss on Revaluation M = ₹ 27,075, N = ₹ 16,245, G = ₹ 10,830; Amount Transferred to M’s Loan Account = ₹ 2,75,425, M’s Share of Goodwill = ₹ 1,50,000, Gaining Ratio = 1 : 4

Question 29.

Lalit, Madhur and Neena were partners sharing profits as 50%, 30% and 20% respectively. On 31st March, 2013 their balance sheet was as follows

![Reconstitution of Partnership Firm Retirement Death of a Partner Class 12 Important Questions and Answers Accountancy Chapter 4 Img 19]()

On this date, Madhur retired and Lalit and Neena agreed to continue on the following terms

(i) The goodwill of the firm was valued at ₹ 51,000.

(ii) There was a claim for workmen’s compensation to the extent of ₹ 6,000.

(iii) Investments were brought down to ₹ 15,000.

(iv) Provision for bad debts was reduced by ₹ 1,000.

(v) Madhur was paid ₹ 10,300 in cash and the balance was transferred to his loan account payable in two equal instalments together with interest @ 12% per annum.

Prepare revaluation account, partners capital accounts and Madhur’s loan account till the loan is finally paid off. (Delhi (C) 2015)

Answer:

![Reconstitution of Partnership Firm Retirement Death of a Partner Class 12 Important Questions and Answers Accountancy Chapter 4 Img 20]()

Working Note:

Madhur’s share in goodwill = 51,000 × \(\frac{3}{10}\) = ₹ 15,300, which is contributed by Lalit and Neenain the ratio of 5 : 2.

Lalit will pay = 15,300 × \(\frac{5}{7}\) = ₹ 10,929; Neena will pay = 15,300 × \(\frac{2}{7}\) = ₹ 4,371

Reduction in the value of investments have been adjusted through revaluation account

![Reconstitution of Partnership Firm Retirement Death of a Partner Class 12 Important Questions and Answers Accountancy Chapter 4 Img 21]()

Question 30.

X, Y and Z are partners in a firm sharing profits in the ratio of 3 : 2 : 1. On 1st April, 2009, X retires from the firm, Y and Z agrees that the capital of the new firm shall be fixed at ₹ 2,10,000 in the profit sharing ratio. The capital accounts of Y and Z after all adjustments on the date of retirement showed balances of ₹ 1,45,000 and ₹ 63,000 respectively. State the amount of actual cash to be brought in or to be paid to the partners. (Delhi 2010)

Answer:

![Reconstitution of Partnership Firm Retirement Death of a Partner Class 12 Important Questions and Answers Accountancy Chapter 4 Img 22]()

Question 31.

X, Y and Z are partners in a firm sharing profits in the ratio of 3 : 2 : 1. On 1st April, 2009, Y retires form the firm. X and Z agree that the capital of the new firm shall be fixed at ₹ 2,10,000 in the profit sharing ratio. The capital accounts of X and Z after all adjustments on the date of retirement showed balances of ₹ 1,45,000 and ₹ 63,000 respectively. State the amount of actual cash to be brought in or to be paid to the partners. (All India 2010)

Answer:

Calculation of Cash to be Brought In or Paid Out

![Reconstitution of Partnership Firm Retirement Death of a Partner Class 12 Important Questions and Answers Accountancy Chapter 4 Img 23]()

Question 32.

Nandan, John and Rosa are partners sharing profits in the ratio of 4 : 3 : 2. On 1st April, 2012, John gave a notice to retire from the firm. Nandan and Rosa decided to share future profits in the ratio of 1 : 1. The capital accounts of Nandan and Rosa after all adjustments showed a balance of ? 43,000 and ₹ 80,500 respectively. The total amount to be paid to John was ₹ 95,500. This amount was to be paid by Nandan and Rosa in such a way that then- capitals become proportionate to their new profit sharing ratio. Pass necessary journal entries in the books of the firm for the above transactions. Show your workings clearly.

(All India 2013)

Answer:

![Reconstitution of Partnership Firm Retirement Death of a Partner Class 12 Important Questions and Answers Accountancy Chapter 4 Img 24]()

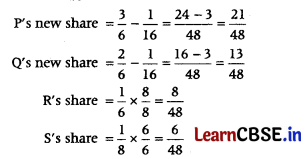

Question 33.

Naresh, David and Aslam are partners sharing profits in the ratio of 5 : 3 : 7. On 1st April, 2012, Naresh gave a notice to retire from the firm. David and Aslam decided to share future profits in the ratio of 2 : 3. The adjusted capital accounts of David and Aslam show a balance of ₹ 33,000 and ₹ 70,500 respectively. The total amount to he paid to Naresh is ₹ 90,500.

This amount is to be paid by David and Aslam in such a way their capitals become proportionate to their new profit sharing ratio. Pass necessary journal entries for the above transactions in the books of the firm. Show your workings clearly. Delhi 2013

Answer:

Solve as Q no. 3 on page no. 177.

Cash to be brought in by David = ₹ 44,600; Aslam = ₹ 45,900

![Reconstitution of Partnership Firm: Retirement/Death of a Partner Class 12 Important Questions and Answers Accountancy Chapter 4]()

Question 34.

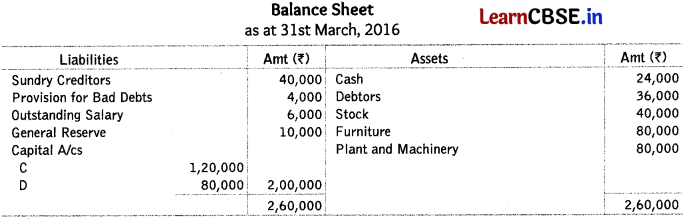

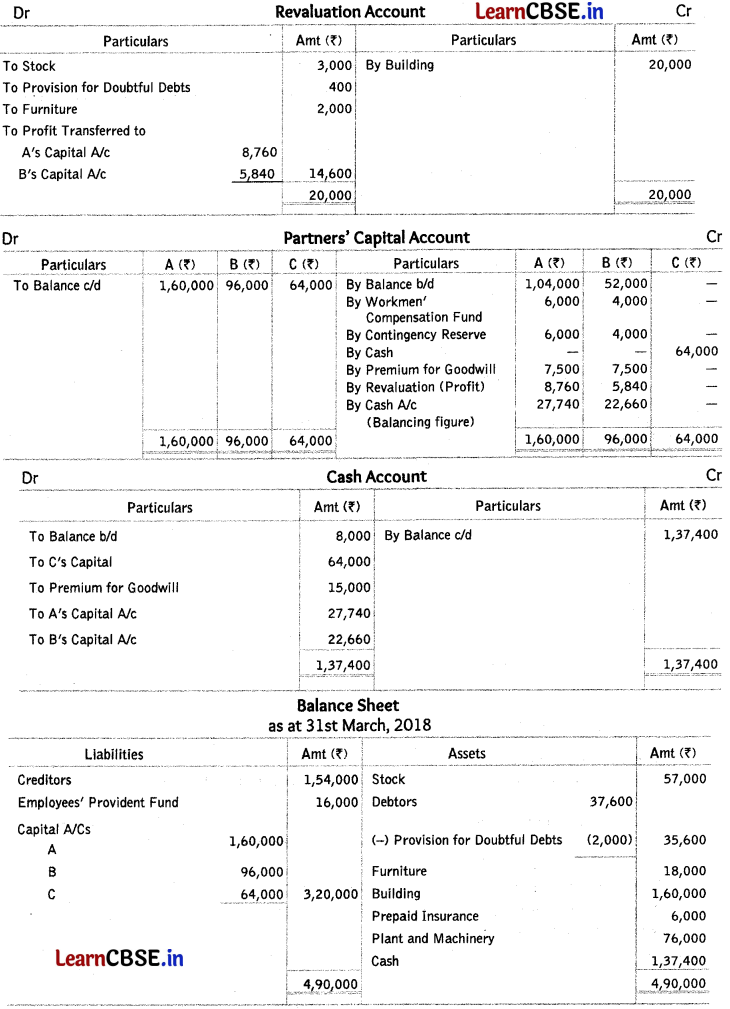

Akul, Bakul and Chandan were partners in a firm sharing profits in the ratio of 2 : 2 : 1. On 31st March, 2018 their balance sheet was as follows

Balance Sheet of Akul, Bakul and Chandan

![Reconstitution of Partnership Firm Retirement Death of a Partner Class 12 Important Questions and Answers Accountancy Chapter 4 Img 25]()

Bakul retired on the above date and it was agreed that

(i) Plant and Machinery was undervalued by 10%.

(ii) Provision for doubtful debts was to be increased to 15% on debtors.

(iii) Furniture was to be decreased to ₹ 87,000.

(iv) Goodwill of the firm was valued at ₹ 3,00,000 and Bakul’s share was to be adjusted through the capital accounts of Akul and Chandan.

(v) Capital of the new firm was to be in the new profit sharing ratio of the continuing partners.

Prepare revaluation account, partners’ capital accounts and balance sheet of the reconstituted firm. (Delhi 2019)

Answer:

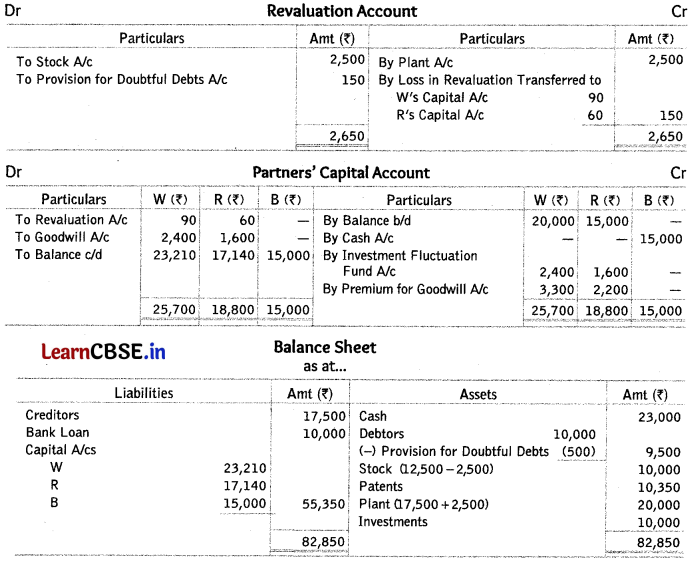

![Reconstitution of Partnership Firm Retirement Death of a Partner Class 12 Important Questions and Answers Accountancy Chapter 4 Img 26]()

![Reconstitution of Partnership Firm Retirement Death of a Partner Class 12 Important Questions and Answers Accountancy Chapter 4 Img 27]()

Working Notes:

1. Plant and machinery (original value) =1,80,000 x \(\frac { 100 }{ 90 }\) = ₹ 2,00,000

2. Firm’s goodwill = ₹ 3,00,000

Bakul’s share of goodwill =3,00,000 x \(\frac { 2 }{ 5 }\) = ₹ 1,20,000 to be contributed by Akul and Chandan in the ratio 2 : 1.

![Reconstitution of Partnership Firm Retirement Death of a Partner Class 12 Important Questions and Answers Accountancy Chapter 4 Img 28]()

Akul’s new capital =1,50,000 x \(\frac { 2 }{ 3 }\) =1,00,000 – 92,000 = ₹ 8,000 cash brought in

Chandan’s new capital =1,50,000 x \(\frac { 1 }{ 3 }\) = 50,000 – 58,000 = ₹ 8,000 cash withdrew

Question 35.

G, E and F were partners in a firm sharing profits in the ratio of 7 : 2 : 1. The balance sheet of the firm as at 31st March, 2018 was as follows

![Reconstitution of Partnership Firm Retirement Death of a Partner Class 12 Important Questions and Answers Accountancy Chapter 4 Img 29]()

E retired on the above date. On E’s retirement the following was agreed upon

(i) Land and building were revalued at ₹ 1,88,000, machinery at ₹ 76,000 and stock at ₹ 10,000 and goodwill of the firm was valued at ₹ 90,000.

(ii) A provision of 2.5% was to be created on debtors for doubtful debts.

(tii) The net amount payable to E was transferred to his loan account to be paid later on.

(iv) Total capital of the new firm was fixed at ₹ 2,40,000 which will be adjusted according to their new profit sharing ratio by opening current accounts.

Prepare revaluation account, partners’ capital accounts and balance sheet of reconstituted firm. (All India 2019)

Answer:

![Reconstitution of Partnership Firm Retirement Death of a Partner Class 12 Important Questions and Answers Accountancy Chapter 4 Img 30]()

![Reconstitution of Partnership Firm Retirement Death of a Partner Class 12 Important Questions and Answers Accountancy Chapter 4 Img 31]()

Question 36.

Mohan, Vinay and Nitya were partners in a firm sharing profits and losses in the proportion of \(\frac { 1 }{ 2 }\), \(\frac { 1 }{ 3 }\) and \(\frac { 1 }{ 6 }\) respectively. On 31st March, 2018 their balance sheet was as follows

![Reconstitution of Partnership Firm Retirement Death of a Partner Class 12 Important Questions and Answers Accountancy Chapter 4 Img 32]()

Mohan retired on the above date and it was agreed that

(i) Plant and machinery will be depreciated by 5%.

(ii) An old computer previously written off was sold for ₹ 4,000.

(iii) Bad debts amounting to ₹ 3,000 will be written off and a provision of 5% on debtors for bad and doubtful debts will be maintained.

(iv) Goodwill of the firm was valued at ₹ 1,80,000 and Mohan’s share of the same was credited in his account by debiting Vinay’s and Nitya’s accounts.

(v) The capital of the new firm was to be fixed at ₹ 90,000 and necessary adjustments were to be made by bringing in or paying off cash as the case may be.

(vi) Vinay and Nitya will share future profits in the ratio of 3 : 2.

Prepare revaluation account, partners’ capital accounts and balance sheet of the reconstituted firm. (All India 2019)

Answer:

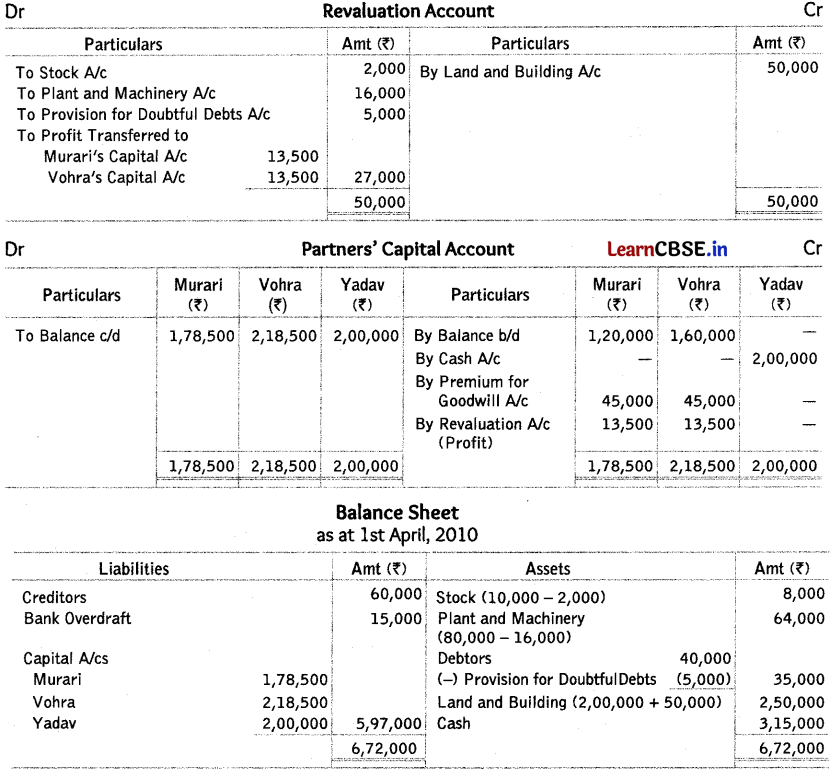

![Reconstitution of Partnership Firm Retirement Death of a Partner Class 12 Important Questions and Answers Accountancy Chapter 4 Img 33]()

![Reconstitution of Partnership Firm Retirement Death of a Partner Class 12 Important Questions and Answers Accountancy Chapter 4 Img 34]()

Working Notes:

1. Calculation of Gaining Ratio

Viray gain = \(\frac{3}{5}-\frac{2}{6}=\frac{18-10}{30}=\frac{8}{30}\)

Nitya = \(\frac{2}{5}-\frac{1}{6}=\frac{12-5}{30}=\frac{7}{30}\)

Gaining ratio = 8 : 7

2. Firm’s goodwill = 1,80,000

Mohan’s share of goodwill = 1,80,000 × \(\frac { 3 }{ 6 }\) = 90,000

Lo be adjusted in gaining ratio, i.e. 8 : 7

Question 37.

Kavya, Manya and Navita were partners sharing profits as 50%, 30% and 20% respectively. On March 31, 2016, their balance sheet stood as follows

Balance Sheet of Kavya, Manya and Navita

![Reconstitution of Partnership Firm Retirement Death of a Partner Class 12 Important Questions and Answers Accountancy Chapter 4 Img 35]()

On the above date, Kavya retired and Manya and Navita agreed to continue the business on the following terms

(i) Firm’s goodwill was valued at ₹ 60,000 and it was decided to adjust Kavya’s share to goodwill in the capital accounts of continuing partners.

(ii) There was claim for workmen’s compensation to the extent of ₹ 4,000.

(iii) Investments were revalued at ₹ 2,13,000.

(iv) Fixed assets were to be depreciated by 10%.

(v) Kavya was to be paid ₹ 20,000 through a bank draft and the ablance was transferred to her loan account which will be paid in two equal annual instalments together with interest @ 10% p.a.

Prepare revaluation account, partners capital accounts and Kavya’s loan account till it is finally paid. (Comportment 2018)

Answer:

Solve as Q.no. 6 on page 180-181.

Revaluation loss Kavya = ₹ 40000

40,000 Manya = ₹ 24,000

Navita = ₹ 16,000

Capital balance Manya = ₹ 4,88,000

Navita = ₹ 3,92,000

Kavya’s Loan A/c = ₹ 6,20,000

1st Year = ₹ 3,72,000

2nd Year = ₹ 3,41,000

Question 38.

J, H and K were partners in a firm sharing profits in the ratio of 5 : 3 : 2. On 31st March, 2015 their balance sheet was as follows

![Reconstitution of Partnership Firm Retirement Death of a Partner Class 12 Important Questions and Answers Accountancy Chapter 4 Img 36]()

On the above date, H retired and J and K agreed to continue the business on the following terms

(i) Goodwill of the firm was valued at ₹ 1,02,000.

(ii) There was a claim of ₹ 8,000 for workmen’s compensation.

(iii) Provision for bad debts was to be reduced by 12,000.

(iv) H will be paid ₹ 14,000 in cash and the balance will be transferred in his loan account which will be paid in four equal yearly instalments together with interest @ 10% per annum.

(v) The new profit sharing ratio between J and K will be 3 : 2 and their capitals will be in their new profit sharing ratio. The capital adjustments will be done by opening current accounts.

Prepare revaluation account, partners capital accounts and balance sheet of the new firm. (All India 2016)

Answer:

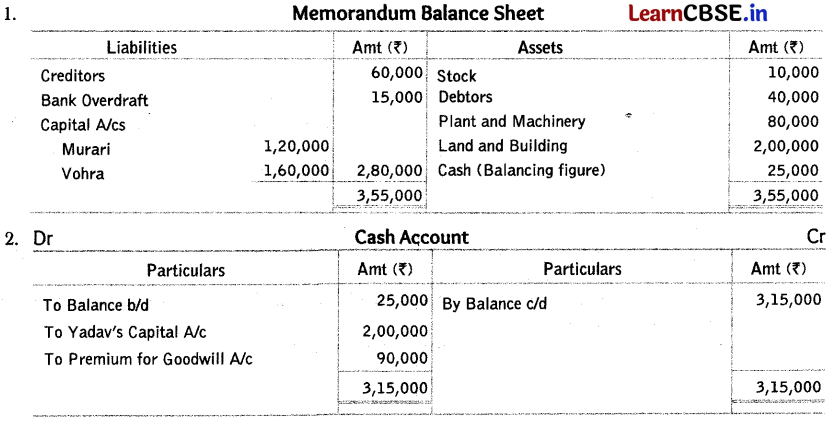

![Reconstitution of Partnership Firm Retirement Death of a Partner Class 12 Important Questions and Answers Accountancy Chapter 4 Img 37]()

Working Notes:

1. Calculation of Gaining Ratio

Gaining Ratio = New Share – Old Share

J = \(\frac{3}{5}-\frac{5}{10}=\frac{6-5}{10}=\frac{1}{10}\); K = \(\frac{2}{5}-\frac{2}{10}=\frac{4-2}{10}=\frac{2}{10}\)

Gaining ratio = 1 : 2

2. Adjustment for Goodwill Firm’s goodwill = ₹ 1,02,000

H’s share of goodwill = 1,02,000 × \(\frac { 3 }{ 10 }\) = ₹ 30,600 will be debited to gaining partners, i.e. J and K in gaining ratio, i.e. 1 : 2

J’s share = 30,600 × \(\frac { 1 }{ 3 }\) = ₹ 10,200; K’s share = 30,600 × \(\frac { 2 }{ 3 }\) = ₹ 20,400

3. Adjustment of Capital

J’s capital after adjustment = 1,36,800

(+) K’s capital after adjustment = 38,400

Total capital of new firm = ₹ 1,75,200

J’s adjusted capital = 1,75,200 × \(\frac { 3 }{ 5 }\) = ₹ 1,05,120; K’s adjusted capital = 1,75,200 × \(\frac { 2 }{ 5 }\) = ₹ 70,080

![Reconstitution of Partnership Firm: Retirement/Death of a Partner Class 12 Important Questions and Answers Accountancy Chapter 4]()

Question 39.

X, Y and Z were partners in a firm sharing profits in the ratio of 5 : 3 : 2. On 31st March, 2015 their balance sheet was as follows

![Reconstitution of Partnership Firm Retirement Death of a Partner Class 12 Important Questions and Answers Accountancy Chapter 4 Img 38]()

On the above date, Y retired and X and Z agreed to continue the business on the following terms

(i) Goodwill of the firm was valued at ₹ 51,000.

(ii) There was a claim of ₹ 4,000 for workmen’s compensation.

(iii) Provision for bad debts was to be reduced by ₹ 1,000.

(iv) Y will be paid ? 8,200 in cash and the balance will be transferred in his loan account which will be paid in four equal yearly instalments together with interest @ 10% per annum.

(v) The new profit sharing ratio between X and Z will be 3 : 2 and their capitals will be in their new profit sharing ratio. The capital adjustments will be done by opening current accounts.

Prepare revaluation account, partners’ capital accounts and the balance sheet of the reconstituted firm. (Delhi 2016)

Answer:

Solve as Q no. 9 on page 184-186.

Loss on Revaluation Account: X = ₹ 1,500, Y = ₹ 900, Z = ?600; Balance in Partners’ Capital Accounts:

X = ₹ 52,560, Z = ₹ 35,040; Balance in Current Accounts: X = ₹ 15,840 (Credit), Z = ₹ 15840 (Debit);

Balance Sheet Total = ₹ 1,89,640; Y’s Loan Account = ₹ 61,200.

Question 40.

Leena, Madan and Naresh were partners in a firm sharing profits and losses in the ratio of 2 : 2 : 3. On 31st March, 2015 their balance sheet was as follows

![Reconstitution of Partnership Firm Retirement Death of a Partner Class 12 Important Questions and Answers Accountancy Chapter 4 Img 39]()

On 31st March, 2015, Madan retrired from the firm and the remaining partners decided to

carry on the business. It was decided to revalue assets and liabilities as under

(t) Land and building be appreciated by ₹ 2,40,000 and machinery be depreciated by 10%.

(ii) 50% of investments were taken over by the retiring partner at book value.

(iii) An old customer Mohit whose account was written-off as bad debt had promised to pay ₹ 7,000 in settlement of his full debt of ₹ 10,000.

(in) Provision for doubtful debts was to be made at 5% on debtors.

(v) Closing stock will be valued at market price which is ₹ 1,00,000 less than the book value.

(vi) Goodwill of the firm be valued at ₹ 5,60,000 and Madan’s share of goodwill be adjusted in the accounts of Leena and Naresh. Leena and Naresh decided to share future profits and losses in the ratio of 3 : 2.

(vii) The total capital of the new firm will be ₹ 32,00,000 which will be in the proportion of the profit sharing ratio of Leena and Naresh.

(uiii) Amount due to Madan was settled by accepting a bill of exchange in his favour payable after 4 months.

Prepare revaluation account, partners capital accounts and balance sheet of the firm after

Madan’s retirement. (All India (C) 2016)

Answer:

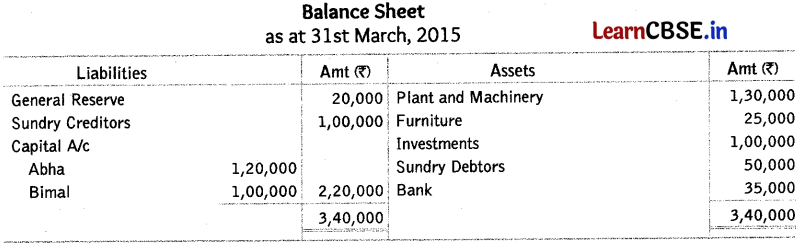

![Reconstitution of Partnership Firm Retirement Death of a Partner Class 12 Important Questions and Answers Accountancy Chapter 4 Img 40]()

Working notes:

1. Calculation of Gaining Ratio

Gaining Ratio = New Share – Old Share

Leena = \(\frac{3}{5}-\frac{2}{7}=\frac{21-10}{35}=\frac{11}{35}\); Naresh = \(\frac{2}{5}-\frac{3}{7}=\frac{14-15}{35}= \frac{1}{35}\) sacrifice

2. Calculation of Share of Goodwill

Madan’s share of goodwill = 5,60,000 × \(\frac { 2 }{ 7 }\) = ₹ 1,60,000 to be contributed by Leena alone. As she is the only gaining partner, she will compensate to Naresh also.

3. Calculation of Capital of Partners in New firm

New profit sharing ratio = 3 : 2

Leena’s capital = 32,00,000 × \(\frac { 3 }{ 5 }\) = ₹ 19,20,000; Naresh’s capital = 32,00,000 x \(\frac { 2 }{ 5 }\) = ₹ 12,80,000

![Reconstitution of Partnership Firm Retirement Death of a Partner Class 12 Important Questions and Answers Accountancy Chapter 4 Img 41]()

5. It is mentioned in the question that an old customer Mohit had promised to pay ₹ 7,000 in settlement of his debt, since it is an oral promise it is not considered as a transaction, therefore Mohit has been considered as the debtor of the firm.

Question 41.

On 31st March, 2015 the balance sheet of Saman, Harish and Meeta who were sharing profits and losses in the ratio of 2 : 3 : 2 stood as follows

![Reconstitution of Partnership Firm Retirement Death of a Partner Class 12 Important Questions and Answers Accountancy Chapter 4 Img 42]()

On 31st March, 2015 Harish retired from the firm and the remaining partners decided to carry on the business. It was agreed to revalue the assets and liabilities as follows

(i) Land and buildings be appreciated by 20%.

(ii) Machinery be depreciated by 20%.

(iii) Closing stock be valued at ₹ 4,50,000.

(iv) Provision for doubtful debts be made at 5% on debtors.

(v) Sundry creditors of ₹ 65,000 be written-off.

(vi) Goodwill of the firm be valued at ₹ 5,60,000 and Harish’s share of the goodwill be adjusted in the accounts of Saman and Meeta who will share the future profits and losses in the ratio of 3 : 2.

(vii) The total capital of the newly constituted firm will be ₹ 35,00,000, which will be adjusted by opening current accounts.

(viii) Amount due to Harish was settled by accepting a bill of exchange in his favour payable after 4 months.

Prepare revaluation account, partners’ capital accounts and balance sheet of the new firm on Harish’s retirement. (Delhi (C) 2016)

Answer:

Solve as Q no. 11 on page 187-189.

Profit on Revaluation Account: Saman = ₹ 74,286, Harish = ₹ 1,11,428, Meeta = ₹ 74,286; Balance in Partners’ Capital Account:Saman = ₹ 21,00,000, Meena = ₹ 14,00,000; Total of Balance Sheet = ₹ 61,56,428, Gaining Ratio = 11 : 4; Partners’ Current Account (Dr) Saman = ₹ 9,61,714, Meeta = ₹ 1,49,714

Question 42.

Xavier, Yusuf and Zaman were partners in a firm sharing profits in the ratio of 4 : 3 : 2. On 1st April, 2014 their balance sheet was as follows

![Reconstitution of Partnership Firm Retirement Death of a Partner Class 12 Important Questions and Answers Accountancy Chapter 4 Img 43]()

Yusuf had been suffering from ill health and thus gave notice of reitrement from the firm. An agreement was, therefore, enterd into as on 1st April, 2014, the terms of which were as follows

(i) That land and building be appreciated by 10%.

(ii) The provision for bad debts is no longer necessary.

(iii) That stock be appreciated by 20%.

(iv) That goodwill of the firm be fixed at ₹ 54,000. Yusuf s share of the same be adjusted into Xavier’s and Zaman’s capital accounts, who are going to share future profits in the ratio of 2 : 1.

(v) The entire capital of the newly constituted firm be readjusted by bringing in or paying necessary cash so that the future capitals of Xavier and Zaman will be in their profits sharing ratio.

Prepare revaluation account and partners capital accounts. (All India 2015)

Answer:

![Reconstitution of Partnership Firm Retirement Death of a Partner Class 12 Important Questions and Answers Accountancy Chapter 4 Img 44]()

Working notes:

1. Calculation of Gaining Ratio

Gaining Ratio = New Share – Old Share

Xavier = \(\frac{2}{3}-\frac{4}{9}=\frac{6-4}{9}=\frac{2}{9}\); Zaman = \(\frac{1}{3}-\frac{2}{9}=\frac{3-2}{9}=\frac{1}{9}\)

Gaining ratio = 2 : 1

2. Adjustment of Goodwill:

Yusuf’s share of goodwill = 54,000 x \(\frac { 3 }{ 5 }\) = ₹ 18,000 to be contributed in gaining ratio, i.e. 2 : 1

Xavier will pay =18,OOO x \(\frac { 2 }{ 3 }\) = ₹ 12,000; Zaman will pay = 18,000 x \(\frac { 1 }{ 3 }\) = ₹ 6,000

3. Calculation of New Capitals

![Reconstitution of Partnership Firm Retirement Death of a Partner Class 12 Important Questions and Answers Accountancy Chapter 4 Img 45]()

Adjusted Capital of Xavier Adjusted Capital of Zaman Amount Due to Yusuf Total Capital of New Firm

Xavier’s new capital = 2,95,650 x \(\frac { 2 }{ 3 }\) = ₹ 1,97,100

Zaman’s new capital = 2,95,650 x \(\frac { 1 }{ 3 }\) = ₹ 98,550

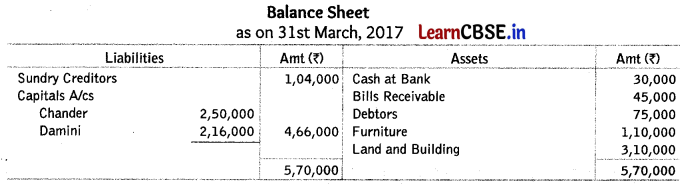

Question 43.

Amit, Balan and Chander were partners in a firm sharing profits in the proportion of \(\frac { 1 }{ 2 }\), \(\frac { 1 }{ 3 }\) and \(\frac { 1 }{ 6 }\) respectively. Chander retired on 1st April, 2014. The balance sheet of the firm on the date of Chander’s retirement was as follows

![Reconstitution of Partnership Firm Retirement Death of a Partner Class 12 Important Questions and Answers Accountancy Chapter 4 Img 46]()

It was agreed that

(i) Goodwill will be valued at ₹ 27,000.

(ii) Depreciation of 10% was to be provided on machinery.

(iii) Patents were to be reduced by 20%.

(iv) Liability on account of provident fund was estimated at ₹ 2,400.

(v) Chander took over investments for ₹ 15,800.

(vi) Amit and Balan decided to adjust their capitals in proportion of their profit sharing ratio by opening current accounts.

Prepare revaluation account and partners’ capital accounts on Chander’s retirement. (Delhi 2015)

Answer:

![Reconstitution of Partnership Firm Retirement Death of a Partner Class 12 Important Questions and Answers Accountancy Chapter 4 Img 47]()

Working Notes:

1. Adjustment for Goodwill

Chander’s share in goodwill = 27,000 x \(\frac { 1 }{ 6 }\) = ₹ 4,500; to be contributed in gaining ratio, i.e. 3 : 2

Amit will pay = 4,500 x \(\frac { 3 }{ 5 }\) = ₹ 2,700

Balan will pay = 4,500 x \(\frac { 2 }{ 5 }\) = ₹ 1,800

2. Adjustment for Capital

Combined capital ⇒ Amit’s adjusted capital = 42,100

Balan’s adjusted capital = 37,900

Total = 80,000

New profit sharing ratio = 3 : 2

Amit’s new capital = 80,000 x \(\frac { 3 }{ 5 }\) = ₹ 48,000

Chander’s new capital = 80,000 x \(\frac { 2 }{ 5 }\) = ₹ 32,000

Question 44.

Lokesh, Mansoor and Nihal were partners in a firm sharing profits as 50%, 30% and 20% respectively. On 31st March, 2014, their balance sheet was as follows

![Reconstitution of Partnership Firm Retirement Death of a Partner Class 12 Important Questions and Answers Accountancy Chapter 4 Img 48]()

On the above date, Mansoor retired and Lokesh and Nihal agreed to continue on the following terms

(i) Firm’s goodwill was valued at ₹ 1,02,000 and it was decided to adjust Mansoor’s share of goodwill into the capital accounts of the continuing partners.

(iii) There was a claim for workmen’s compensation to the extent of ₹ 12,000 and investments were brought down to ₹ 30,000.

(iv) Provision for bad debts was to be reduced by ₹ 2,000.

(iv) Mansoor was to be paid ₹ 20,600 in cash and the balance will be transferred to his loan account which was paid in two equal instalments together with interest @ 10% per annum.

(v) Lokesh’s and Nihal’s capitals were to be adjusted in their new profit sharing ratio by bringing in or paying off cash as the case may be.

Prepare revaluation account and partners’ capital accounts. (All India 2015)

Answer:

![Reconstitution of Partnership Firm Retirement Death of a Partner Class 12 Important Questions and Answers Accountancy Chapter 4 Img 49]()

Working Notes:

1. Calculation of Share of Goodwill

Mansoor’s share of goodwill = 1,02,000 × \(\frac { 3 }{ 10 }\) = ₹ 30,600, to be contributed by Lokesh and Nihal in gaining ratio, i.e. 5 : 2

Lokesh will pay = 30,600 × \(\frac { 5 }{ 7 }\) = ₹ 21,857; Nihal will pay = 30,600 x \(\frac { 2 }{ 7 }\) = ₹ 8,743

2. Calculation of Capital of New Firm after Mansoor’s Retirement

Lokesh’s capital after adjustment = 68,143

Nihal’s capital after adjustment = 21,257

total = ₹ 89,400

Lokesh’s new capital = 89,400 × \(\frac { 5 }{ 7 }\) = ₹ 63,857

Nihal’s new capital =89,400 × \(\frac { 2 }{ 7 }\) = ₹ 25,543

Question 45.

L, M and N were partners in a firm sharing profits in the ratio of 2 : 1 : 1. On 1st April, 2013 their balance sheet was as follows

![Reconstitution of Partnership Firm Retirement Death of a Partner Class 12 Important Questions and Answers Accountancy Chapter 4 Img 50]()

On the above date, N retired. The following were agreed

(i) Goodwill of the firm was valued at ₹ 6,00,000.

(ii) Land was to be appreciated by 40% and building was to be depreciated by ₹ 1,00,000.

(iii) Furniture was to be depreciated by ₹ 30,000.

(iv) The liabilities for workmen’s compensation fund was determined at ₹ 1,60,000.

(v) Amount payable to N was transferred to his loan account.

(vi) Capitals of L and M were to be adjusted in their new profit sharing ratio and for this purpose current accounts of the partners will be opened.

Prepare revaluation account, partner’s capital accounts and the balance sheet of the new firm. (All India 2014)

Answer:

![Reconstitution of Partnership Firm Retirement Death of a Partner Class 12 Important Questions and Answers Accountancy Chapter 4 Img 51]()

Working Notes:

1. Firm’s goodwill = ₹ 6,00,000

N’s share of goodwill = 6,00,000 × \(\frac { 1 }{ 4 }\) = 1,50,000 to be contributed by L and M in gaining ratio i.e., 2 : 1

L = 1,50,000 × 2/3 = ₹ 1,00,000, M = 1,50,000 × 1/3 = ₹ 50,000

2. Calculation of Proportionate’s Capital

L’s capital after all adjustment = 9,15,000

M’s capital after all adjustment = 6,37,500

Total capital of new firm = ₹ 15,52,500

L’s new capital =15,52,500 x \(\frac { 2 }{ 3 }\) = ₹ 10,35,000

M’s new capital =15,52,500 x \(\frac { 1 }{ 3 }\) = ₹ 5,17,500

Question 46.

Kushal, Kumar and Kavita were partners in a firm sharing profits in the ratio of 3 : 1 : 1. On 1st April, 2012 their balance sheet was as follows

![Reconstitution of Partnership Firm Retirement Death of a Partner Class 12 Important Questions and Answers Accountancy Chapter 4 Img 52]()

On the above date, Kavita retired and the following was agreed

(i) Goodwill of the firm was valued at ₹ 40,000.

(ii) Land was to be appreciated by 30% and building was to be depreciated by ₹ 1,00,000.

(iii) Value of furniture was to be reduced by ₹ 20,000.

(iv) Bad debts reserve is to be increased to ₹ 15,000.

(v) 10% of the amount payable to Kavita was paid in cash and the balance was transferred to her loan account.

(vi) Capitals of Kushal and Kumar will be in proportion to their new profit sharing ratio. The surplus/deficit, if any in their capital accounts will be adjusted through current accounts.

Prepare revaluation account, partner’s capital accounts and balance sheet of Kushal and Kumar after Kavita’s retirement. (Delhi 2014)

Answer:

![Reconstitution of Partnership Firm Retirement Death of a Partner Class 12 Important Questions and Answers Accountancy Chapter 4 Img 53]()

Working Note:

1. Finn’s goodwill = ₹ 40,000

Kavita’s share of goodwill – 40,000 × \(\frac { 1 }{ 5 }\) = ₹ 8,000, to be contributed by Kushal and Kumar in gaining ratio, i.e. 3 : 1; Kushal = 8,000 × \(\frac { 3 }{ 4 }\) = ₹ 6,000; Kumar = 8,000 × \(\frac { 1 }{ 4 }\) = ₹ 2,000

2. Adjustment of Capital

Adjusted capital of Kushal = 3,63,000

Adjusted capital of Kumar = 3,01,000 ₹

Total = 6,64,000

New profit sharing ratio = 3 : 1

New capital of Kushal = 6,64,000 × \(\frac { 3 }{ 4 }\) = ₹ 4,98,000

New capital of Kumar = 6,64,000 × \(\frac { 1 }{ 4 }\) = ₹ 1,66,000

![Reconstitution of Partnership Firm: Retirement/Death of a Partner Class 12 Important Questions and Answers Accountancy Chapter 4]()

Question 47.

State the basis of calculating the amount of profit payable to the legal representative of a deceased partner in the year of death. (All India 2019)

Answer:

Amount of profit can be calculated on time basis or sales basis.

Question 48.

Dinkar, Navita and Vani were partners sharing profits and losses in the ratio of 3 : 2 : 1. Navita died on 30th June, 2017. Her share of profit for the intervening period was based on the sales during that period, which were ₹ 6,00,000. The rate of profit during the past four years had been 10% on sales. The firm closes its books on 31st March every year.

Calculate Navita’s share of profit. (All india 2019)

Answer:

Total sales = ₹ 6,00,000 (1st April, 2017-30th June, 2017)

Finn’s profit on sales = 600000 × 10% = ₹ 60,000

Navita’s share of profit = 60000 × \(\frac { 2 }{ 6 }\) = ₹ 20,000

Question 49.

Jayant, Kartik and Leena were partners in a firm sharing profits and losses in the ratio of 6 : 2 : 3. Kartik died and Jayant and Leena decided to continue the business. Their gaining ratio was 2 : 3. Calculate the new profit sharing ratio of Jayant and Leena. (CBSE 2018)

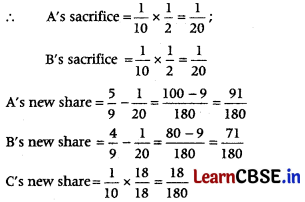

Answer:

Jayant’s old share = \(\frac { 5 }{ 10 }\) Jayant’s gaining share = \(\frac{2}{5} \times \frac{2}{10}=\frac{4}{50}\)

Jayant’s New Share = Old Share + Gaining share = \(\frac{5}{10}+\frac{4}{50}=\frac{25+4}{50}=\frac{29}{50}\)

Leena’s old share = \(\frac { 3 }{ 10 }\); Leena’s gaining share = \(\frac{3}{5} \times \frac{2}{10}=\frac{6}{50}\)

Leena s new share = \(\frac{3}{10}+\frac{6}{50}=\frac{15+6}{50}=\frac{21}{50}\)

New profit sharing ratio = Jayant : Leena = 29 : 21

Question 50.

In which ratio do the remaining partners acquire the share of the deceased partner? (Comport mant 2018)

Answer:

The remaining partners will acquire the share of the deceased partner in gaining ratio.

Question 51.

Kumar, Verma and Naresh were partners in a firm sharing profit and loss in the ratio of 3 : 2 : 2. On 23rd January, 2015, Verma died. Verma’s share of profit till the date of his death was calculated at ₹ 2,350.

Answer:

![Reconstitution of Partnership Firm Retirement Death of a Partner Class 12 Important Questions and Answers Accountancy Chapter 4 Img 54]()

Question 52.

Differentiate between ‘profit and loss appropriation account’ and ‘profit and loss suspense account’. (All India (C) 2015)

Answer:

Profit & Loss Appropriation Account:

Objective Profit and loss appropriation account is prepared to show the distribution of net profit among the partners.

Profit & Loss Suspense Account:

Profit and loss suspense account is prepared to adjust the deceased partner’s share of profit upto the date of his death.

Question 53.

Name the account which is opened to credit the share of profit of the deceased partner, till the time of his death to his capital account. (All India 2015; Modified; Delhi 2013)

Answer:

‘Profit and loss suspense account’ is opened, to credit the share of profit of the deceased partner.

Question 54.

A, T and R were partners in a firm sharing profits in the ratio of 5 : 6 : 7 respectively. Their capitals were ₹ 5,00,000; ₹ 6,00,000 and ₹ 7,00,000 respectively. State the ratio in which the goodwill of the firm amounting to ₹ 16,00,000 will be adjusted in the capital accounts of A and T in case of R’s death. (Comportment 2014)

Answer:

Goodwill of the firm, at the time of R’s death, will be adjusted among A and T in gaining ratio, i.e. 5 : 6.

Question 55.

At what rate is interest payable on the amount remaining unpaid to the executor of deceased partner? (All India 2013)

Answer:

Interest is payable @ 6% per annum on the amount remaining unpaid to the executor of deceased partner.

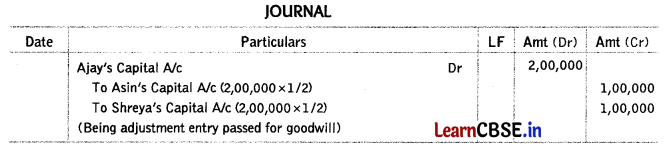

Question 56.

Ajay, Bhawna and Shreya were partners sharing profits in the ratio 2 : 2 : 1. On 1st July, 2017, Shreya died. The books of accounts are closed on 31st March every year. Sales for the year 2016-17 amounted to ₹ 5,00,000 and that from 1st April to 30th June, 2017 were ₹ 1,40,000. The rate of profit during the past three years had been 10% on sales. It was decided that the profit for the purpose of settling Shreya’s account is to be calculated as 20% on sales.

Calculate Shreya’s share of profits till the date of her death and pass necessary a journal entry for the same. (Comportment 2018)

Answer:

Shreya’s share of profit = 1,40,000 × \(\frac { 20 }{ 100 }\) × \(\frac { 1 }{ 5 }\) = ₹ 5,600

![Reconstitution of Partnership Firm Retirement Death of a Partner Class 12 Important Questions and Answers Accountancy Chapter 4 Img 55]()

Question 57.

A, B and C are partners in a firm whose books are closed on 31st March each year. B died on 30th June, 2009 and according to the agreement, the share of profit of a deceased partner up to the date of the death is to be calculated on the basis of the average profits for the last five years.

The net profits for the last 5 years have been 2005 : ₹ 14,000; 2006 : ₹ 18,000; 2007 : ₹ 16,000; 2008 : ₹ 10,000 (loss) and 2009 : ₹ 16,000. Calculate B’s share of profita upto the date of death and pass necessary journal entry. (All India; 2010)

Answer:

Calculation of B’s Share of Profit

Last 5 years’ total profit = 14,000 + 18,000 + 16,000 – 10,000 + 16,000 = ₹ 54,000

Average profit = \(\frac { 54,000 }{ 5 }\) = ₹ 10,800

B’s Share of profit = 10,800 × \(\frac { 1 }{ 3 }\) × \(\frac { 3 }{ 12 }\) = 900

![Reconstitution of Partnership Firm Retirement Death of a Partner Class 12 Important Questions and Answers Accountancy Chapter 4 Img 56]()

Question 58.

Garima, Harish and Reena were partners in a firm sharing profits and losses equally. On 31st March, 2015, Harish died and the amount payable to his executors was ₹ 90,000. It was agreed between the remaining partners and Harish’s executors that the executors will be paid in four equal yearly instalments alongwith interest @18% per annum starting from 31st March, 2018.

Prepare Harish’s executor’s account till it is finally closed. (All India 2019)

Answer:

![Reconstitution of Partnership Firm Retirement Death of a Partner Class 12 Important Questions and Answers Accountancy Chapter 4 Img 57]()

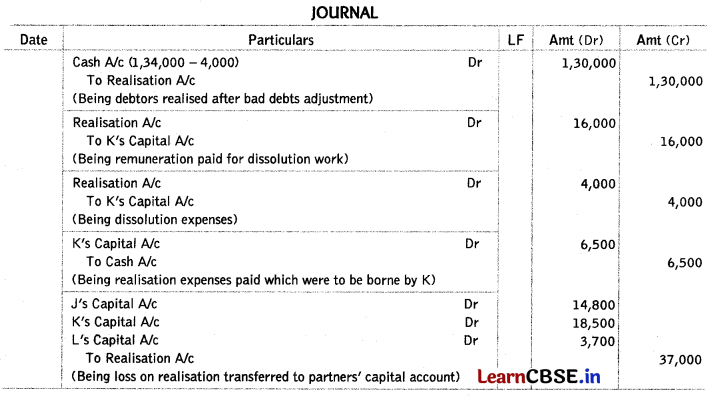

Question 59.

Manika, Rekha and Mohit were partners sharing profits in the ratio of 5 : 4 : 1. On 31st March, 2018 their balance sheet was as follows

![Reconstitution of Partnership Firm Retirement Death of a Partner Class 12 Important Questions and Answers Accountancy Chapter 4 Img 58]()

Rekha died on 1st July, 2018. According to the partnership deed, her executors were entitled to

(i) Balance in her capital account.

(ii) Her share of goodwill, which is calculated on the basis of average profits of last four years.

(iii) Her share of profit upto the date of death calculated on the basis of average profits of last two years. The time period for which she survived in the year of death will be calculated in months.

(iv) Interest on capital @ 10% p.a. upto the date of death.

The firm’s profits for the last four years were 2014-15: ₹ 2,20,000, 2015-16: ₹ 3,00,000: 2016-17: ₹ 3,60,000 and 2017-18: ₹ 3,20,000.

Rekha’s executors were paid the amount due immediately. Prepare Rekha’s Capital Account to be presented to her executors. (All India 2019)

Answer:

![Reconstitution of Partnership Firm Retirement Death of a Partner Class 12 Important Questions and Answers Accountancy Chapter 4 Img 59]()

Working Notes:

1. 4 year’s total profit = 2,20,000 + 3,00,000 + 3,60,000 + 3,20,000 = ₹ 12,00,000

Average profit or goodwill = \(\frac { 1200000 }{ 4 }\) = 3,00,000

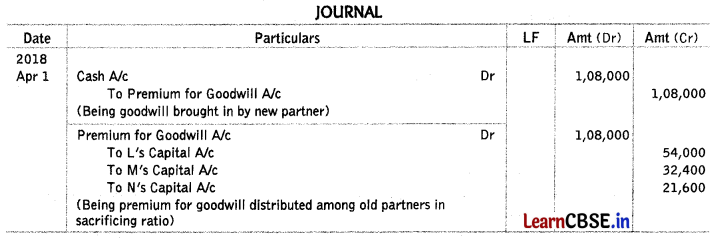

Rekha’s share of goodwill = 3,00,000 x \(\frac { 4 }{ 10 }\) = ₹ 120,000 to be contributed by Manika and Mohit in the ratio of 5 : 1.

2. 2 years average profit = \(\frac { 3,60,000+3,20,000 }{ 2 }\) = ₹ 3,40,000

Rekha’s share of profit = 3,40,000 x \(\frac { 4 }{ 10 }\) x \(\frac { 3 }{ 12 }\) = ₹ 34,000

3. Interest on capital = 4,50,000 x \(\frac { 10 }{ 100 }\) x \(\frac { 3 }{ 12 }\) = ₹ 11,250

Question 60.

Meera, Sarthak and Rohit were partners sharing profits in the ratio of 2 : 2 : 1. On 31st March, 2018 their balance sheet as follows

![Reconstitution of Partnership Firm Retirement Death of a Partner Class 12 Important Questions and Answers Accountancy Chapter 4 Img 60]()

(i) Balance in his capital account.

(ii) His share of goodwill will be calculated on the basis of thrice the average of the past 4 years’ profits.

(iii) His share in profits upto the date of death on the basis of average profits of the last two years.

The time period for which he survived in the year of death will be calculated in months.

(iv) Interest on capital @ 12% p.a. upto the date of his death.

The firm’s profits for the last four years were 2014-15 : ₹ 1,20,000, 2015-16 : ₹ 2,00,000, 2016-17 : ₹ 2,60,000 and 2017-18 : ₹ 2,20,000.

Sarthak’s executors were paid the amount due immediately. Prepare Sarthaks’s capital account to be presented to his executors. (All Indio 2019)

Answer: Solve as Q. no. 13 on page 204-205.

Sarthak’s share of goodwill = ₹ 2,40,000

Sarthak’s share of profit = ₹ 201300

Debit Sarthak’s capital account with amount = ₹ 658,750

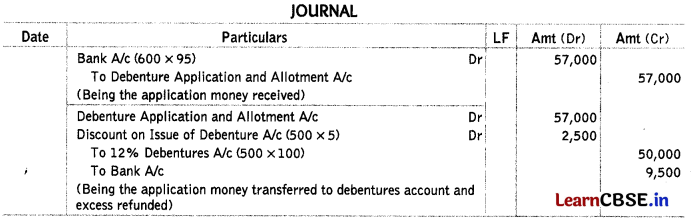

Question 61.

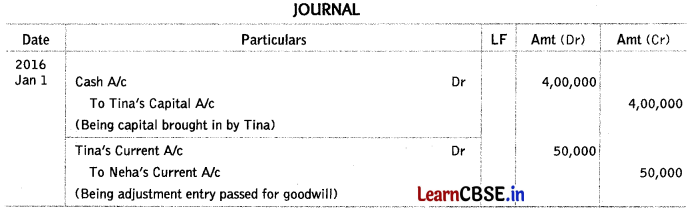

Ashok, Babu and Chetan were partners in a firm sharing profits in the ratio of 4 : 3 : 3. The firm closes its books on 31st March every year. On 31st December, 2016, Ashok died. The partnership deed provided that on the death of a partner, his executors will be entitled to the following

(i) Balance in his capital account. On 1st April, 2016, there was a balanee of ₹ 90,000 in Ashok’s capital account.

(ii) Interest on capital @ 12% per annum.

(iii) His share in the profits of the firm in the year of his death will be calculated on the basis of rate of net profit on sales of the previous year, which was 25%. The sales of the firm till 30th December, 2016 were ₹ 4,00,000.

(iv) His share in the goodwill of the firm. The goodwill of the firm on Ashok’s death was valued at ₹ 4,50,000.

The partnership deed also provided for the following deductions from the amount payable to the executor of the deceased partner.

(i) His drawings in the year of his death. Ashok’s drawings till 31st December, 2016 were ₹ 15,000.

(ii) Interest on drawing @ 12% per annum which was calculated as ₹ 1,500.

The accountant of the firm prepared Ashok’s capital account to be presented to the executor of Ashok but in a hurry, he left it incomplete. Ashok’s capital account as prepared by the firm’s accountant is given below

![Reconstitution of Partnership Firm Retirement Death of a Partner Class 12 Important Questions and Answers Accountancy Chapter 4 Img 61]()

You are required to complete Ashok’s capital account. (All India 2017)

Answer:

![Reconstitution of Partnership Firm Retirement Death of a Partner Class 12 Important Questions and Answers Accountancy Chapter 4 Img 62]()

Working Notes:

1. Calculation of Interest on Capital

= 90,000 x \(\frac{12}{100} \times \frac{9}{12}\) = ₹ 8,100

2. Calculation of Profit

= 4,00,000 x \(\frac{25}{100} \times \frac{4}{10}\) = ₹ 40,000

3. Calculation of Ashok’s Share of Goodwill

Ashok’s share of goodwill = 4,50,000 x \(\frac { 4 }{ 10 }\) = ₹ 1,80,000 to be contributed by Babu and Chetan in gaining ratio, It. 3 : 3 or 1 : 1.

Question 62.

Sandeep, Mandeep and Amandeep were partners in a firm sharing profits in the ratio of 2:2:1. The firm closes its books on 31st March every year. On 30th September, 2015 Mandeep died. The partnership deed provided that on the death of a partner, his executors will be entitled to the following

(i) Balance in his capital account and interest @ 12% per annum on capital. On 1st April, 2016 the balance in Mandeep’s capital account was ₹ 1,00,000.

(ii) His share in the profits of the fir m in the year of his death which will be calculated on the basis of rate of net profit on sales of the previous year which was 25%. The sales of the firm till 30th September, 2016 were ₹ 9,00,000.

(iii) His share in the goodwill of the firm. The goodwill of the firm on Mandeep’s death was valued at ₹ 1,50,000.

The partnership deed also provided that the following deductions will be made from the amount payable to the executor of the deceased partner

(a) His drawing in the year of his death. Mandeep’s drawings till 30th September, 2016 were ₹ 4,000.

(b) Interest on drawing @ 6% per annum which was calculated as ₹ 120.

The accountant of the firm prepared Mandeep’s capital account to be presented to the executor of Mandeep but in a hurry, he left it incomplete.

Mandeep’s capital account prepared by accountant of the firm is shown below

![Reconstitution of Partnership Firm Retirement Death of a Partner Class 12 Important Questions and Answers Accountancy Chapter 4 Img 63]()

You are required to complete Mandeep’s capital account. (Delhi 2017)

Answer:

Solve as Q no. 15 on page 205 and 206.

Amount Transferred to Mandeep’s Executor Account = ₹ 2,51,880.

Question 64.

Manav, Nath and Narayan were partners in a firm sharing profits in the ratio of 1: 2 : 1.

The firm closes its books on 31st March every year. On 30th September, 2015, Nath died. On that date, his capital account showed a debit balance of ₹ 5,000. There was a debit balance of ₹ 30,000 in the profit and loss account. The goodwill of the firm was valued at ₹ 3,80,000. Nath’s share of profit in the year of his death was to be calculated on the basis of average profit of last 5 years, which was ₹ 90,000.

Pass necessary journal entries in the books of the firm on Nath’s death. (All India 2016)

Answer:

![Reconstitution of Partnership Firm Retirement Death of a Partner Class 12 Important Questions and Answers Accountancy Chapter 4 Img 64]()

Working Note:

1. Calculation of Nath’s Share of Goodwill

Firm’s goodwill = ₹ 3,80,000; Nath’s share of goodwill = 3,80,000 x \(\frac { 2 }{ 4 }\) = ₹ 1,90,000

2. Calculation of Amount Transferred to Nath’s Executors Account

![Reconstitution of Partnership Firm Retirement Death of a Partner Class 12 Important Questions and Answers Accountancy Chapter 4 Img 65]()

Question 65.

Vikas, Vishal and Vaibhav were partners in a firm sharing profits in the ratio of 2 : 2 : 1. The firm closes its books on 31st March every year. On 31st December, 2015, Vaibhav died. On that date his capital account showed a credit balance of ₹ 3,80,000 and goodwill of the firm was valued at ₹ 1,20,000. There was a debit balance of ₹ 50,000 in the profit and loss account. Vaibhav’s share of profit in the year of his death was to be calculated on the basis of the average profit of last five years. The average profit of last five years was ₹ 75,000.

Pass necessary journal entries in the books of the firm on Vaibhav’s death. (Delhi 2016)

Answer:

Solve as Q no. 17 on page 207 and 208.

Amount Transferred to Vaibhav’s Executor Account = ₹ 4,05,250;

Vaibhav’s Share of Goodwill = ₹ 24,000; Vaibhav’s Share of Profit = ₹ 11,250

Question 66.

Ram, Ghanshyam and Vrinda were partners in a firm sharing profits in the ratio of 4 : 3 : 1. The firm closes its books on 31st March every year. On 1st February, 2015, Ghanshyam died and it was decided that the new profit sharing ratio between Ram and Vrinda will be equal. The partnership deed provided for the following, on the death of a partner.

(a) His share of goodwill be calculated on the basis of the half of the profits credited to his account during the previous four completed years. The firm’s profit for the last four years was: 2010-2011 ₹ 1,20,000, 2011-2012 ₹ 80,000, 2012-2013 ₹ 40,000 and 2013-2014 ₹ 80,000.

(b) His share of profit in the year of his death was to be computed on the basis of average profits of past two years.

Pass necessary journal entries relating to goodwill and profit to be transferred to Ghanshyam’s capital account. Also show your workings clearly. (Delhi 2016)

Answer:

![Reconstitution of Partnership Firm Retirement Death of a Partner Class 12 Important Questions and Answers Accountancy Chapter 4 Img 66]()

Working Note:

1. Calculation of Gaining Ratio

Gaining Ratio = New Share – Old Share

Ram = \(\frac{1}{2}-\frac{4}{8}=\frac{4-4}{8}\) = Nil; Vrinda = \(\frac{1}{2}-\frac{1}{8}=\frac{4-1}{8}=\frac{3}{8}\)

Since Vrinda is the gaining partner, only she will contribute.

2. Calculation of Share of Goodwill:

Ghanshyam’s share in goodwill = (1,20,000 +80,000 + 40,000 +80,000) x \(\frac { 1 }{ 2 }\) x \(\frac { 3 }{ 8 }\) = ₹ 60,000

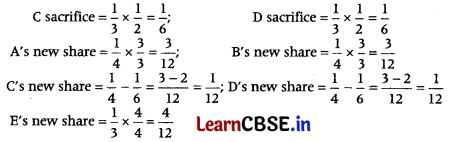

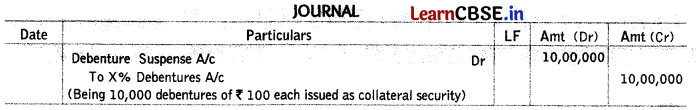

Question 67.

Monu, Nigam and Shreya were partners in a firm sharing profits and losses in the ratio of 4 : 3 : 1. The firm closes its books on 31st March every year. As per the terms of partnership deed on the death of any partner, the share of goodwill of the deceased partner will be calculated on the basis of 50% of the net profits credited to the partners’ capital account during the last four completed years before death. Monu died on 1st July, 2015.

The profits for last four years were:

2011-12 – 97,000

2012-13 – 1,05,000

2013-14 – 30,000

2014-15 – 84,000

His share of profit in the year of his death was to be calculated on the basis of sales. Sales for the year ended 31st March, 2015 amounted to ₹ 21,00,000. From 1st April, 2015 to 30th June, 2015 the firm’s sales were ₹ 2,00,000.

Pass necessary journal entries relating to the amount of goodwill and profit to be transferred to Monu’s capital account. Also show your workings clearly. (All India 2016)

Answer:

![Reconstitution of Partnership Firm Retirement Death of a Partner Class 12 Important Questions and Answers Accountancy Chapter 4 Img 67]()

Working Notes:

1. Calculation of Share of Goodwill

Monu’s share in goodwill = (97,000 +1,05,000 +30,000 +84,000) x \(\frac { 50 }{ 100 }\) x \(\frac { 4 }{ 8 }\) = ₹ 79,000

2. Calculation of Share in Profit

Monu’s share in profit = \(\frac { 84000 }{ 2100000 }\) x 2,00,000 x \(\frac { 4 }{ 8 }\) = ₹ 4,000

![Reconstitution of Partnership Firm: Retirement/Death of a Partner Class 12 Important Questions and Answers Accountancy Chapter 4]()

Question 68.

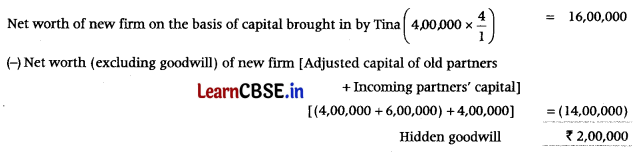

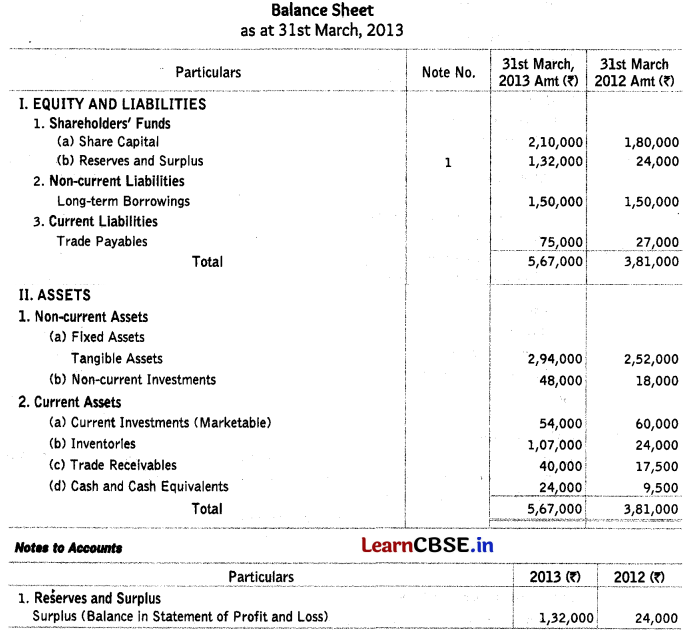

Arun, Varun and Karan were partners in a firm sharing profits in the ratio of 4 : 3 : 3. On 31st March, 2014 their balance sheet was as follows

![Reconstitution of Partnership Firm Retirement Death of a Partner Class 12 Important Questions and Answers Accountancy Chapter 4 Img 68]()

On 30th September, 2014, Karan died. The partnership deed provided for the following to the executors of the deceased partner.

(i) His share in the goodwill of the firm calculated on the basis of three years purchase of the average profits of the last four years. The profits of the last four years were ₹ 1,90,000; ₹ 1,70,000; ₹ 1,80,000 and ₹ 1,60,000 respectively.

(ii) His share in the profits of the firm till the date of his death calculated on the basis of the average profits of the last four years.

(iii) Interest @ 8% per annum on the credit balance, if any, in his capital account.

(iv) Interest on his loan @ 12% per annum.

Prepare Karan’s capital account to he presented to his executors, assuming that his loan and interest on loan were transferred to his capital account. (All India 2015)

Answer:

![Reconstitution of Partnership Firm Retirement Death of a Partner Class 12 Important Questions and Answers Accountancy Chapter 4 Img 69]()

Working Note:

1. Calculation of Share of Goodwill

Average profit = \(\frac{1,90,000+1,70,000+1,80,000+1,60,000}{4}\) = 1,75,000

Goodwill = Average Profit × Number of Years Purchase

= 1,75,000 x 3 = ₹ 5,25,000

Karan’s share = 5,25,000 × \(\frac { 3 }{ 10 }\) = ₹ 1,57,500, to be contributed by Arun and Varun in gaining ratio i.e. 4 : 3, Arun will contribute = 1,57,500 x \(\frac { 4 }{ 7 }\) = ₹ 90,000, Varun will contribute = ₹ 1,57,500 x \(\frac { 3 }{ 7 }\) = ₹ 67,500

2. Calculation of Profit upto Death

Average profit = ₹ 1,75,000

Karan’s share of profit = 1,75,000 x \(\frac { 3 }{ 6 }\) x \(\frac { 6 }{ 12 }\) = ₹ 26,250

NOTE: As there is no credit balance in capital account of Karan, he will not get interest on capital.

Question 69.

Sunny, Honey and Rupesh were partners in a firm. On 31st March, 2014 their balance sheet was as follows

![Reconstitution of Partnership Firm Retirement Death of a Partner Class 12 Important Questions and Answers Accountancy Chapter 4 Img 70]()

Honey died on 31st December, 2014. The partnership deed provides that the representatives of the deceased partner shall be entitled to

(i) Balance in the capital account of the deceased partner.

(ii) Interest on capital @ 6% per annum upto the date of his death.

(iii) His share in the undistributed profits or losses as per the balance sheet.

(iv) His share in the profits of the firm till the date of his death, calculated on the basis of rate of net profit on sales of the previous year. The rate of net profit on sale of previous year was 20%. Sales of the firm during the year till 31st December, 2014 was ₹ 6,00,000.

Prepare Honey’s capital account to be presented to his executors. (Delhi 2015)

Answer:

![Reconstitution of Partnership Firm Retirement Death of a Partner Class 12 Important Questions and Answers Accountancy Chapter 4 Img 71]()

Question 70.

Dev, Swati and Sanskar were partners in a fir pi sharing profits in the ratio of 2 : 2 : 1. On 31st March, 2014 their balance sheet was as follows

![Reconstitution of Partnership Firm Retirement Death of a Partner Class 12 Important Questions and Answers Accountancy Chapter 4 Img 72]()

On 30th June, 2014 Dev died. According to partnership agreement, Dev was entitled to interest on capital at 12% per annum. His share of profit till the date of his death was to be calculated on the basis of the average profits of last four years.

The profits of the last four years were

2010-2011 – 2,04,000

2011-2012 – 1,80,000

2012-2013 – 90,000

2013-2014 (Loss) – 57,000

On 1st April, 2014, Dev withdrew ₹ 15,000 to pay for his medical bills. Prepare Dev’s account to be presented to his executors. (Delhi 2018)

Answer:

![Reconstitution of Partnership Firm Retirement Death of a Partner Class 12 Important Questions and Answers Accountancy Chapter 4 Img 73]()

Working Note:

1. Calculation of Interest on Capital

= 77000 × \(\frac{12}{100} \times \frac{3}{12}\)

2. Calculation of Profit upto Date of Death

Average profit = \(\frac{2,04,000+1,80,000+90,000-57,000}{4}\) = 1,04,250

Dev’s share of profit = 1,04,250 x \(\frac { 2 }{ 5 }\) x \(\frac { 3 }{ 12 }\) = 10,425

Question 71.

On 31st March, 2014, the balance sheet of Pooja, Qureshi and Ross, who were partners in a firm was as under

![Reconstitution of Partnership Firm Retirement Death of a Partner Class 12 Important Questions and Answers Accountancy Chapter 4 Img 74]()

Qureshi died on 1st July, 2014. The profit sharing ratio of the partners was 2 : 1 : 1. On the death of the partner, the partnership deed provided for the following

(i) His share in the profits of the firm till the date of his death will be calculated on the basis of average profit of last three completed years.

(ii) Goodwill of the firm will be calculated on the basis of total profit of last two years.

(iii) Interest on loan given by the firm to a partner will be charged at the rate of 6% per annum or ₹ 4,000 whichever is more.

(iv) Profits for the last three years were ₹ 45,000, ₹ 48,000 and ₹ 33,000.

Prepare Qureshi’s capital account to be rendered to his executors. (Delhi to 2015)

Answer:

![Reconstitution of Partnership Firm Retirement Death of a Partner Class 12 Important Questions and Answers Accountancy Chapter 4 Img 75]()

Working Notes:

1. Calculation of Qureshi’s Share in Profit upto Death

Average profit = \(\frac { 45000+48000+33000 }{ 3 }\) = ₹ 42,000; Qureshi s share = 42,000 x \(\frac { 1 }{ 4 }\) x \(\frac { 3 }{ 12 }\) = ₹ 2,625

2. Calculation of Share of Goodwill

Goodwill = 48,000 +33,000 = ₹ 81,000; Qureshi’s share = 81,000 x \(\frac { 1 }{ 4 }\) = ₹ 20,250

Pooja will pay = 20,250 x \(\frac { 2 }{ 3 }\) = ₹ 13,500; Ross will pay = 20,250 x \(\frac { 1 }{ 3 }\) = ₹ 6,750

Question 72.

Monika, Sonika and Manisha were partners in a firm sharing profits in the ratio of 2 : 2 : 1 respectively. On 31st March, 2013 their balance sheet was as under

![Reconstitution of Partnership Firm Retirement Death of a Partner Class 12 Important Questions and Answers Accountancy Chapter 4 Img 76]()

Sonika died on 30th June, 2013. It was agreed between her executors and the remaining partners that

(i) Goodwill of the firm be valued at 3 years’ purchase of average profits for the last four years. The average profits were ₹ 2,00,000.

(it) Interest on capital be provided at 12% per annum.

(iti) Her share in the profits upto the date of death will be calculated on the basis of average profits for the last 4 years.

Prepare Sonika’s capital as on 30th June, 2013. (All India 2014)

Answer:

![Reconstitution of Partnership Firm Retirement Death of a Partner Class 12 Important Questions and Answers Accountancy Chapter 4 Img 77]()

Working Notes:

1. Calculation of Sonika’s Share of Goodwill

Average profit of last 4 years = ₹ 2,00,000; Firm’s goodwill = 2,00,000 x 3 = ₹ 6,00,000

Sonika’s share = 6,00,000 x \(\frac { 2 }{ 5 }\) = ₹ 2,40,000 5

Gaining ratio of Monika and Manisha = 2 : 1

Monika will contribute = 2,40,000 x \(\frac { 2 }{ 3 }\) = ₹ 1,60,000;

Manisha will contribute = 2,40,000 x \(\frac { 1 }{ 3 }\) = ₹ 80,000

2. Calculation of Sonika’s Share of Profit

Sonika’s share of profit = 2,00,000 x \(\frac { 2 }{ 5 }\) x \(\frac { 3 }{ 12 }\) = ₹ 20,000

Question 73.

Virad, Vishad and Roma were partners in a firm sharing profits in the ratio of 5 : 3 : 2 respectively. On 31st March, 2013 their balance sheet was as under

![Reconstitution of Partnership Firm Retirement Death of a Partner Class 12 Important Questions and Answers Accountancy Chapter 4 Img 78]()

Virad died on 1st October, 2013. It was agreed between his executors and the remaining partner’s that

(i) Goodwill of the firm be valued at 2\(\frac { 1 }{ 2 }\) years purchase of average profits for the last three years. The average profits were ₹ 1,50,000.

(ii) Interest on capital be provided at 10% per annum.

(iii) Profit for the year 2013-14 be taken as having accrued at the same rate as that of the previous year which was ₹ 1,50,000. Prepare Virad’s capital account to be presented to his executors as on 1st October, 2013. (Delhi 2014)

Answer:

Solve as Q no. 22 on page 211 and 212.

Amount Transferred to Virad’s Executors Account = ₹ 5,70,000

Question 74.

Girija, Yatin and Zubin were partners sharing profits in the ratio 5 : 3 : 2. Zubin died on 1st August, 2015. Amount due to Zubin’s executor after all adjustments was ₹ 90,300. The executor was paid ₹ 10,300 in cash immediately and the balance in two’equal annual instalments with interest @ 6% p.a. starting from 31st March, 2017. Account are closed on 31st March each year.

Prepare Zubin’s executors account till he is finally paid. (Delhi 2019)

Answer:

![Reconstitution of Partnership Firm Retirement Death of a Partner Class 12 Important Questions and Answers Accountancy Chapter 4 Img 79]()

Question 75.

Pranav, Karan and Rahim were partners in a firm sharing profits and losses in the ratio of 2 : 2 : 1. On 31st March, 2017 their balance sheet was as follows